Initiated by ROFF, the BI Centre of risk and insurance research, an industry-academic insurance seminar was held at Handelshøyskolen BI in Oslo, during March, 2014. The purpose of the seminar was to address the relationship between customer satisfaction and the incidence of consumer insurance fraud and abuse (CIFA). Insurer and regulatory management of CIFA have largely been viewed through the lenses of law enforcement (esp. large-scale, organized fraud), and/or the domain of individual insurers’ tolerance for both abuse and fraud throughout the processes associated with recruiting, administering, and retaining customers. For those single-claims frauds originating in opportunism by and among consumers, insurers employ a range of tactics of varying sophistication to identify and reduce the incidence of application- and claims fraud. It can be said that this model envisions customers as somewhat untrustworthy, with selfish motives, and it has seen near-universal adoption by the property casualty community, and among regulatory bodies concerned with oversight of insurance. Conversely, recent research has underscored the co-creation—shared responsibility for—the incidence of CIFA in the exchange of promises surrounding an insurance transaction (Lesch and Brinkmann 2011). This paradigm, one customer-centric, focuses on customer satisfaction as the mutual goal of the parties and characterizes a portion of CIFA as response to a failure of the insurer to meet expectations, or arising from a mix of factors, among the most important of which is customers’ perceived fairness or equity in their interactions with the insurer. Customers whose expectations are not met or customers who feel they have been treated unjustly in their exchange with the insurer are by definition not satisfied and some portion will engage in a range of actions to balance the equation. Consistent with growing literature on customer retaliation, these may include escalation of claims processes (including resort to the courts), policy cancellation-non renewal-brand switching, negative word-of-mouth, and/or CIFA (e.g., Hirschman 1970; Blodgett 1994; Bougie, Pieters, and Zeelenberg 2003; Miyazaki 2009; Macintosh and Stevens 2013)

The Importance of Reducing CIFA and Improving Customer Satisfaction

The national and international prevalence of CIFA is well-known, costly, and has been to varying degrees documented by researchers, regulators, and the industry (Lesch and Byars, 2008; Morley, Ball, and Ormerod, 2006). In the US, for example, a variety of techniques have been deployed (closed claim file analysis; consumer scenarios; consumer surveys; suspicious referrals analysis and tracking) to estimate the number and nature of fraudulent or abusive consumer practices.[2] The property-casualty losses in the US have been estimated to be in the range of $80 billion annually (Coalition Against Insurance Fraud 2008), and Accenture Consulting has recently suggested that only 20% of fraudulent claims are detected during the claims adjusting process (Costonis and Bramblet 2010). Survey data demonstrate consumer appreciation of the cost to policy-holders of CIFA and the importance of detection (e.g., Coalition Against Insurance Fraud 2007; Costonis and Bramblet 2010). But, these same and related research studies also demonstrate the presence of consumer segments where attitudes vary from near-acceptance of CIFA, to near-rejection of the same (Brinkmann and Lentz 2006), with a range of factors contributing to how consumers feel offenders should be managed (Lesch and Baker 2011).

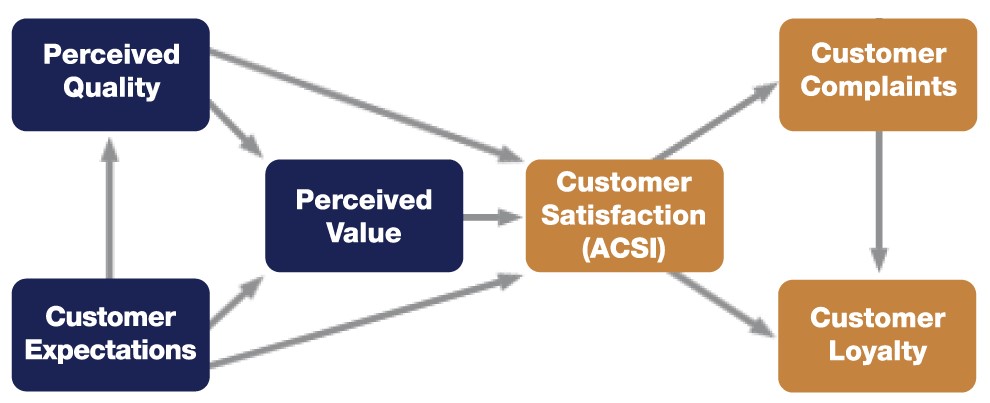

Recent research on consumer satisfaction generally as well as investigation of the insurance industry specifically suggest that the quality of insurer interactions with their customers has a strong effect on not only customer satisfaction, but customer attitudes toward CIFA (Baker and Lesch 2013; Lesch and Baker 2011; Costonis and Bramblet 2010). The more general model used to assess customer satisfaction is well-represented by by the JD Power organization, as well as the American Customer Satisfaction Index (ACSI) of The University of Michigan focusing on service quality. The JD Power process affords normed comparisons along a number of dimensions of insurer performance (e.g., http://ratings.jdpower.com/insurance/ratings/909201799/2014-U.S.+Auto+Insurance+Study/index.htm?sortBy=Policy%20Offerings%20desc), but does not, however, provide for a linkage to CIFA. The ACSI reflects a general model which has been used across a range of industries and internationally. It is shown in Figure 1.[3]

[i] This seminar and note focus only on CIFA and consumer satisfaction. Abuses on the side of the insurer or insurance industry have been documented elsewhere. See for example Ericson and Doyle (2006); Berardinelli (2008).

[ii] See http://theacsi.org/about-acsi/the-science-of-customer-satisfaction.

Figure 1

From this vantage, the challenge to insurers is more clear. Insurance services are inherently heterogeneous, and of a credence nature, with little bases for customers to form reliable or informed attitudes about quality, or expected performance. Their (consumers’) roles and expectations, as well as perceptions of value are decidedly ambiguous given the nature of the insurance product/promise, i.e., to pay a legitimate, covered loss according to the terms of the (complex) agreed upon terms of contract. What comprises an acceptable claim varies by insurer, and what constitutes acceptable performance by the insurer from the point of view of the consumer varies widely, conditioned by the nature of the claim, the coverage, the circumstances of the loss, the level of involvement of the policy-holder to the satisfaction of the agreement, etc. Notably, the recent report by JD Powers reveals that the most important driver of auto insurance switching is a poor experience with the current carrier (28%) although reduction in value precipitated by rate hikes were also important; see http://www.jdpower.com/press-releases/2014-us-insurance-shopping-study).

For dissatisfied customers, whether they stay or switch, the question remains the same: what post-exchange complainant behaviors apply, including retaliation in the form of CIFA? Conceiving of CIFA as an outcome of dissatisfaction opens the door to not only its reduction in prevalence and magnitude, but also to possible routes to greater satisfaction and improved customer loyalty and retention. Indirect evidence from Costonis and Bramblet reveal attributions of higher incidence of CIFA by survey respondents under circumstance of dissatisfaction. This is not inconsistent with data from the CAIF, or re-analyses of the 2007 CAIF survey by Lesch and Baker (2012) suggesting that one’s ethical stance is an important contributor in the decision about CIFA, but that perceived service quality—in the form of fairness—also impacts their posture on CIFA and how it should be managed (more liberally, or, more strictly). To the consumer, maintaining or recovering one’s position at equity in the relationship may in fact be accomplished through CIFA. Given widespread concern about the fairness of the industry in the administration of the insurance product, issues of value, trust, and quality of service—contributing to satisfaction or dissatisfaction and complaints—present as society-wide concerns and warrant oversight by the regulatory communities.

Recognizing the association between satisfaction and CIFA, insurers and regulators have a stake in the improvement of the former and the reduction of the latter. Such a strategy can be justified both in a societal responsibility perspective and as a business case (stronger customer retention and thus higher profitability and competitiveness for the companies choosing such a strategy). In other words and in simple language: improved customer satisfaction pays by reduced losses through CIFA.

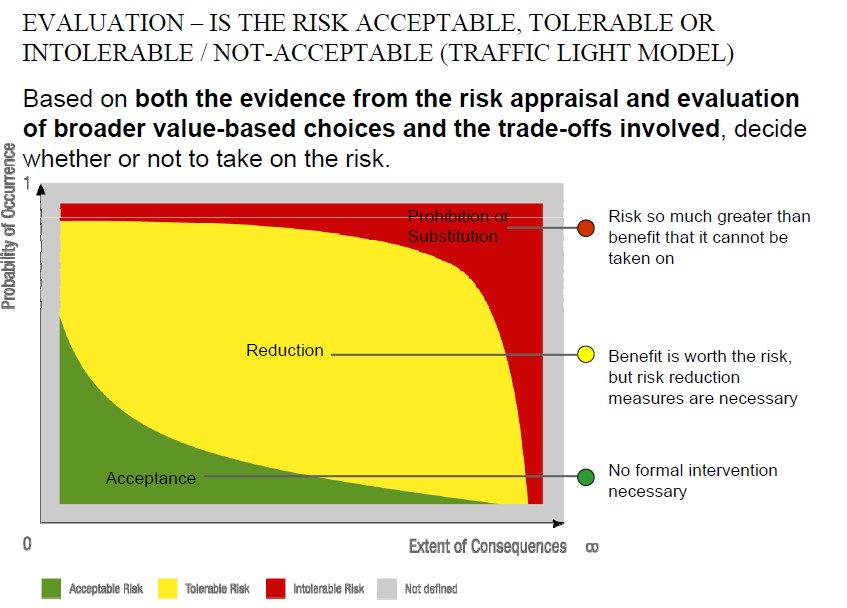

There is little doubt that extra-large size organized crime cases deserve (and receive) both company and media attention, given their societal importance. However, one should not forget the many more, smaller-size incidences of CIFA which in total most likely produce even larger overall losses. The usual risk concept as frequency of occurrence multiplied with seriousness of consequences is helpful for understanding this: many minor amount abuse cases can cost at least in total as much as the fewer more costly ones in total, or with the standard visualization (see figure 2; we suggest to include the upper left area rather than concentrating on the lower right area only):

Figure 2

The seriousness of extra-large size criminal cases can often justify invasive investigations given the proportionality principles in privacy protection legislation. Less known perhaps, Scandinavian companies are in fact entitled to use their own customer data for improving smaller size case investigations, since one can assume informed customer consent for such data use (just consider potential preventive effects of telling the customers that companies try their best within abuse prevention for keeping the premium low).

Eventually, it is suggested that insurance companies put themselves into the shoes of their customers and adopt a shared responsibility perspective, one more customer -centric. This means, once again, a greater focus on customers’ needs, improving their understanding of terms of coverage, and satisfaction with the many possible elements of service provided by the insurer. An important early step includes the identification of groups with varying needs and behavioral tendencies, in this case by likelihood of engaging in CIFA. According to the US four faces study (which was replicated in a pilot study among Norwegian and German business students), there are two extreme groups who are unlikely to be responsive to efforts to reduce CIFA. The so-called critics are opportunistic when it comes to CIFA, while the moralists would typically not exploit any opportunity of CIFA, due to moral barriers. In other words, the two groups in the middle, the realists and the conformists, are the most interesting ones to communicate with and potentially address, since their insurance abuse inclination depends on what the other customers do, or on other circumstances, e.g., possibly customer satisfaction.[4]

The most interesting question is of course if and how such thoughts should be followed up. The many facets of the issue suggest that a discussion leading to development of a strategy for investigation and management would best serve all stakeholders. Once research questions were identified, a first step could be to re-analyze any available secondary data about insurance customer satisfaction and/or attitudes towards CIFA. Another component would be to map communication and exchanges inside the companies, across the different departments such as sales and marketing, underwriting, claims, investigation, marketing research, CSR and customer education in order to ascertain the climate for customer relations. For example, is the firm operating at all levels with a customer-centric philosophy, or, are there disconnections between stated values and policies and the need to recognize customer satisfaction as paramount?

Steps Forward

Seminar participants were asked to frame next steps in the development of such a strategy to identify the linkage between customer satisfaction and the incidence of CIFA. In both groups participants agreed that very little was known and shared among stakeholders about the following:

- the motivations behind insurance fraud and abuse;

- the groups or segments warrantingpriority attention; and/or

- what types of fraud/abuse that were most prevalent/costly.

It was recommended to develop a strategy by which the industry could begin to address these challenges:

- An industry organization (Finans Norge) initiative and/or company case studies could serve as points of departure in order to establish and prioritize research questions;

- What research methods and collaborations would be necessary to carry out the strategy, and within what time horizon;

- Develop a plan to investigate the behavioral aspects of CIFA;

- Such a strategy should depart from a comparison of how other nations and regulators have addressed these questions rather than start “from scratch.”

- Investigate and consider the use of closed-claims files methods and of survey methods to validate and measure the extent of CIFA across the many insurance lines, and why it occurs.

Most insurers do not put resources into behavioral research units which could have been tasked to address the issues associated with CIFA. Insurers should consider tracking customer satisfaction and developing methods to in aggregate, link satisfaction with the quality of claims and the many routes used by customers to engage in CIFA.

Due to a lack of allocated resources or not, as of today, there seems to be a lack of a coordinating authority and coordination of resources in managing CIFA. This could in part be the result of the multidisciplinary nature of CIFA (marketing, consumer behavior, advertising and promotion, claims and adjusting, investigation; regulation and compliance). Nonetheless, all participants suggested that all stakeholders would benefit from a coordinated effort perhaps on involving numerous resources and points of view. What one could do at the outset:

- Form a commission comprised of representative of the stakeholders to the problem.Their mission should include developing the plan outlined above;

- The identification of resources and funding strategies to energize the plan over a defined timeline; and

- The coordination through a designated unit with human and financial resources to make the plan a reality.

Addendum autumn 2014

Meanwhile, the authors have agreed with Gjensidige insurance, Norway, to design and carry out a pilot project from Spring 2015, in line with such thoughts. So, by the end of 2015 we’ll know more, hopefully, about how insurance customer satisfaction and CIFA inclination correlate in Norway, and what one could do for reducing “unnecessary” losses due to minor size CIFA.

Further (academic) readings

Baker, B. and W. Lesch: 2013, Equity and Ethical Environmental Influences on Regulated Business-to-Consumer Exchange, Journal of Macromarketing, 33, 322-341

Berardinelli, D.: 2008, From Good Hands to Boxing Gloves: The Dark Side of Insurance, Portland OR: Trial Guides, LLC

Blodgett, J.: 1994, The Effects of perceived Justice on Complainants’ Repatronage Intentions and Negative Word-of-Mouth Behavior, Journal of Consumer Satisfaction, Dissatisfaction, and Complaining Behavior, 7, 1-14

Bougie, R., R. Pieters, and M. Zeelenberg: 2003, Angry Customers Don’t Come Back, They Get Back: the Experience and Behavioral Implications of Anger and Dissatisfaction in Services, Journal of the Academy of Marketing Science, 31 4, 377-393

Brinkmann, J. and P. Lentz: 2006, Understanding Insurance Customer Dishonesty: Outline of a Moral‐Sociological Approach, Journal of Business Ethics, 66, 177‐195

Coalition Against Insurance Fraud: 2007, Four Faces: Why Some Americans Do—and Do Not—Tolerate Insurance Fraud, research report, Washington, DC, 1-27

Coalition Against Insurance Fraud: 2008, Fraud Easier to Stomach, Coalition Study Reveals, FraudFocus Winter, 1-2

Costonis, M. and J. Bramblet: 2010, Improve Customer Service and Fraud Detection to Deliver High Performance Through Claims: Insurance Fraud Survey 2010, Accessed October 20, 2014, at www.accenture.com/us-en/blogs/accenture-blog-on-insurance/Media/Accenture_Insurance_Consumer_Fraud-Survey-2010.pdf.

Ericson, R. and A. Doyle: 2006, The Institutionalization of Deceptive Sales in Life Insurance: Five Sources of Moral Risk, British Journal of Criminology, 46, 993-1010

Hirschman, A.: 1970, Exit, Voice, and Loyalty: responses to Decline in Firms, Organizations, and States, Cambridge, MA, Harvard University press

Lesch, W. and B. Baker: 2011, Balancing the Insurance Equation: Understanding the Climate for Managing Consumer Insurance Fraud and Abuse, Journal of Insurance Issues, 34, 2, 82-120

Lesch, W. and B. Byars: 2008, Consumer Insurance Fraud in the U.S. Property-Casualty Industry, Journal of Financial Crime, 15 (4), 411-431

Endnotes

[1] The authors extend their appreciation to members of the property-casualty insurance community who attended the seminar.

[2] This seminar and note focus only on CIFA and consumer satisfaction. Abuses on the side of the insurer or insurance industry have been documented elsewhere. See for example Ericson and Doyle (2006); Berardinelli (2008).

[3] See http://theacsi.org/about-acsi/the-science-of-customer-satisfaction.

[4] See http://www.insurancefraud.org/downloads/Four_Faces_07.pdf, e.g. on page p3: “ First, there is the Moralist, which represents the largest group. These people have no tolerance for fraud, see no reason why anyone should ever commit it and support strong punishment against those who do. Next, there is the Realist. These people also have a low-level of tolerance, but understand why some people might justify the fraud they commit in some instances. Next is the Conformist. They are fairly tolerant of fraud. They think everyone is doing it and that it’s no big deal if people take advantage of an opportunity to defraud when presented. Lastly, is the Critic. This was the smallest group at 21 percent, but the most tolerant of insurance fraud and other white-collar crimes. They think insurers only have themselves to blame for the high level of fraud. They tend to blame external forces for things that go wrong in life. They have little regard for big institutions in society, including business, government and the news media. If psychological profiles were done on people convicted of fraud, a strong majority likely would fall into this category. These are not necessarily “born criminals,” and most probably do not commit fraud, but they clearly have no problem with other people committing it….” In Brinkmann’s pilot study among Norwegian and German business students, Conformists and Realists are put together in one group, as “Situationists” (Norwegian business students), or in the other subsample: “Normatives” are a group where conformists and moralists are merged (German business students, see Brinkmann and Lentz 2006 for further details).