Insurance is often perceived as a complex and matter-of-fact service by the customers, and it should create trust. Due to the complex nature of insurance, offering such services in an electronic channel is somewhat challenging. In addition to the complexity of the service product itself, the challenges are related to the environment in which the services are offered. The following article discusses these challenges. As the next step forward, the article provides proposals for service development in the near future in order to overcome the identified challenges.

Introduction

Electronic insurance services have been available to some extent since the mid-1990s. In Finland one of the first insurance Web sites was launched in 1996 by Fennia. In those times, ‘service’ was probably a wrong expression to describe the content of the Web sites. There was rather merely contact information and company information available on the Internet.

Since the start of the millennium, insurance firms have also been creating actual services in the electronic environment. Even though online buying and reporting a claim on the Web have become more common (especially in the case of non-life insurance), searching for information has still remained as the most used electronic insurance service. The reasons are many but at least the complex nature of insurance, the characteristics of an electronic service channel, and long traditions of a physical service contact in insurance issues play a role. The focus of this article is on discussing the first two issues.

The purpose of this article is to identify and characterize the challenges that are related to offering insurance services in an electronic environment. In this regard, two fundamental perspectives are discussed. First of all, a service product approach is elaborated by discussing the crucial characteristics of insurance as a (service) product. Second, a service environment approach is discussed by characterizing the electronic service environment which is in this article limited to concern the Internet only.

However, identifying the challenges is the first step of developing services. Being able to come up with relevant development ideas is a prerequisite for successful designing and, eventually, implementation. Thus, the guidelines for the future development of electronic insurance services and service environment are also discussed in this article. The practical examples of the article are from Finland. Finally, concluding remarks are presented in order to sum up the essential content of the article.

Characterizing Electronic Insurance Services

Service Product Approach

In general terms insurance can be characterized as a complex service which is defined in earlier service literature as “services that consist of many attribute values per attribute, which are often tailor-made, infrequently purchased, more difficult to comprehend, and require in general assistance during the decision-making process” (Vroomen et al. 2005). In order to consider the above presented definition piece-by-piece in insurance context, “many attribute values”, for instance, refers to the multi-dimensional and possibly abstract nature of a service. “Tailor-made” reflects the heterogeneity of insurance service, in other words, a service performance may, and most likely will, vary for different customers. “Infrequently purchased” refers to the fact that complex services are usually purchased and consumed only occasionally. “More difficult to comprehend” refers to the complex and abstract nature, but also to the intangibility, both physical and mental, of insurance.

As mentioned, insurance is an informative service. An insurance product, such as home insurance, consists of a large amount of information according to which the essential content of a service product is determined. This information is usually contains different kinds of regulations, conditions, and juridical clauses. Due to the nature of the information, it is often challenging to the customers to comprehend the content of an insurance service product.

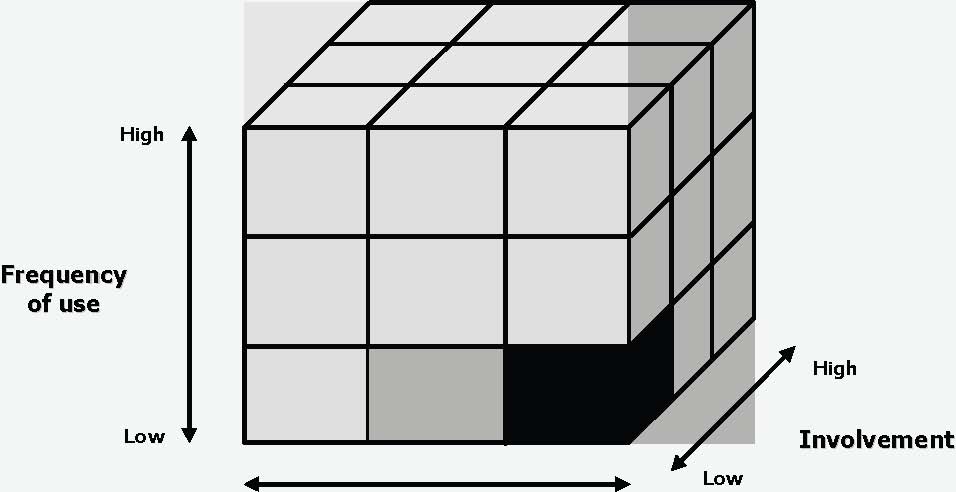

According to a three-dimensional categorization introduced by Ahonen (2007), electronic insurance services can be characterized through involvement, performance, and frequency of use. This classification model is depicted in figure 1.

In the model, “frequency of use” reflects the extent of how often the customers use the service. In the case of insurance, services are usually used only occasionally. This notion is in line with the definition of complex services discussed above. Therefore, the frequency of use is classified as “low”. “Performance” refers to the extent of customer contact required in a service performance. In an electronic service environment customer contact is classified as “high” since the customer is operating according to self-service logic. This topic is discussed more thoroughly in the next sub-chapter. When it comes to customers’ interest in services in general, insurance does not arouse any particular emotions. For most customers insurance is rather a matter that has to be taken care of, nothing more. In this regard, involvement describes felicitously the nature of insurance in both physical and electronic service settings. “Involvement” refers to the customers’ interest and motivation towards a certain service. Referring to the above said, in insurance context the level of involvement is classified as “low”.

Figure 1. A proposed model for classifying electronic insurance services (adapted from Järvinen et al. 2003, 787

To conclude, electronic insurance services as well as insurance services in general can be determined as complex services. Furthermore, (electronic) insurance services possess high level of customer contact required in a service performance, low frequency of use by the customers, and low level of involvement by the customers. These features can be identified among the most crucial challenges for offering electronic insurance services as well as developing them from the service product viewpoint.

Service Environment Approach

Different service environments have their own special characteristics that have influence on the overall service performance. From customers’ point of view, an electronic service environment clearly differs from a physical environment. One of the most crucial distinguishing characteristics is that physical contact with service personnel is not possible but customers are operating according to a self-service logic. More precisely, this means that customers’ operations are restricted to their own competencies and knowledge, and the ability of the electronic service environment to support the electronic service operations. Earlier service literature defines electronic service possibilities, such as ATMs and the Internet, as “self-service technologies” (SSTs) (see e.g. Bitner, Ostrom, and Meuter 2002).

In other words, self-service logic requires more expertise from the customers and, therefore, brings challenges to service providers’ work of developing their electronic service offerings. Customers may end up in a situation where they cannot proceed by relying on their own competencies. In such situations support and assistance of physical service personnel are naturally more than desired. Therefore, it is of utmost importance that service providers are able to provide their customers with sufficient supportive elements in the self-service environment.

Another essential difference refers to customizing the service offering. Every customer values service provider’s ability to offer a service that fits just his or her purposes, and therefore, it is important that service providers are able to offer customized and/or personalized service to their customers. In a physical service environment customers’ wishes are easier to take into account since a customer servant can ask direct questions referring to customers’ needs and wishes. In an electronic service environment customers’ personal needs have usually not, so far, been taken into account as accurately as in the physical service environment. Thus, customiz/ation and personalization of the service offering can be considered essential challenges in the electronic service environment.

Integrated approach

Above the challenges concerning both the nature of insurance as a (service) product and the characteristics of the electronic service environment are separately discussed. However, little is yet said about the challenges that occur when the above mentioned approaches are put together. This sub-chapter elaborates the essential challenges of offering insurance services in an electronic environment.

Although there is nowadays a comprehensive selection of different kinds of services on the Internet, searching for information has remained as the most popular electronic service in insurance context from consumers’ point of view (e.g. Järvinen et al. 2001, Ahonen 2007). Nonetheless, ever since the insurance service sites started to appear on the Internet customers have been claiming that there is often too much information available which makes the use of the sites complicated. Moreover, since insurance information itself is complicated, trying to make oneself familiar with a large amount of such information is even more challenging.

On the other hand, considering that insurance service providers often have legal obligations to present certain pieces of information the large amount of information on the Web can be considered justified to some extent. Nevertheless, insurance service providers can certainly influence on the structure and the logic according to which the information is presented on the Internet. Thus, organizing and presenting the information in the electronic service environment in a way that it appears in a comprehensible form for the customers is one of the greatest challenges for insurance service providers. In this sense, one crucial issue for service providers to consider refers to finding means to reduce the amount of the information provided on the Web but still maintain informativeness.

In addition, it is proposed that in order to get customers better engaged in an electronic service environment the service should be attractive, and thereby, arouse positive emotions among the customers (e.g. Moon and Kim 2001). Hence, in addition to information being comprehensible another essential challenge refers to making electronic insurance services and the overall service environment appealing for the customers.

When it comes to customizing and personalizing electronic insurance services, it is even more challenging than in case of other services due to the complex nature of insurance. Information about customer’s individual needs should be collected, and insurance services should be adapted to those needs in the electronic service environment. In addition all this should be happening in a convenient and appealing manner from customers’ perspective. Otherwise the customers may be reluctant to operate in the electronic insurance service environment.

Guidelines for the Development

Listing problems and challenges is always easier than finding (a) concise and functional solution(s) for solving them. However, from service development point of view it is natural that one should first identify the areas that may require upgrading. In this chapter the next step is taken by providing solutions for overcoming the challenges concerning electronic insurance services which are identified and discussed in more detail in the previous chapter. The discussion in this chapter concerns three distinct but interrelated views on development: theoretical, applied development, and practical implementation.

First of all, prior studies on, for instance, the usability of electronic services have shown that in addition to being easy-to-understand electronic services should possess features that refer to enjoyment, joyfulness, and even playfulness in order to increase customers motivation and willingness to adopt electronic services (Moon and Kim 2001; De Wulf et al. 2006). Concerning insurance business, visualization is recently proposed as a feasible solution to reflect enjoyment and playfulness as well as reducing information overload in the electronic service environment (Ahonen 2007).

At this point representatives within the insurance field may ask “how the above mentioned research findings can be applied to the use of insurance business”? As an example, a Finnish research and development project called “eInsurance” is shortly introduced in the following.

The most crucial practical objective of the eInsurance project was to develop an electronic service concept that facilitates consumers’ electronic insurance service operations. The eInsurance project was conducted between 2003 and 2004, and the project consortium consisted of both research organizations (universities and public research organizations) and business participants (insurance companies and software firms). The project also engendered a follow-up project (eInsurance2) which was carried out between 2005 and 2007. However, the focus of this article is on the first eInsurance project.

In this regard, the key principle of the development work was that in order to make complex natured insurance services easier to understand, they have to be brought closer to customers’ mindset and everyday lives. In the insurance context it has to be pointed out that “customers’ everyday life” is far away from daily insurance business world. Thus, the service provider has to come up with means to speak the same language (not insurance jargon) with customers in the context more familiar with them.

As the most crucial practical result of the project, a service concept called “insurance cover evaluator” that is based on the logic of visualizing the information was introduced in January 2005. In addition to making electronic insurance service environment more comprehensible, it was aimed to make the environment more appealing for the customers through a visual interface. In other words, the developed service concept aimed to get rid of the traditional insurance-like “scroll-down masses of text, read it, try to understand it, and you might, but not necessarily, find what you were looking for” approach on the Internet.

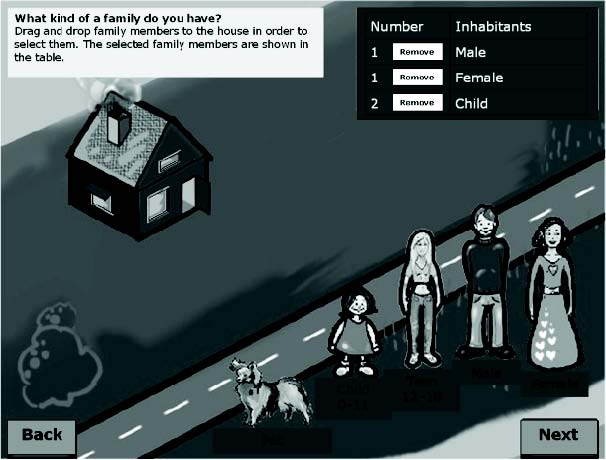

The functioning logic of the “insurance cover evaluator” is that the service concept asks a customer to indicate background information related to his or her current life situation. According to the collected information the system provides the customers with an insurance cover solution customized to their needs and preferences.

User-interaction with the service is carried out by using a graphical user interface through which the customer either selects an object by clicking the mouse button on top of an object

(e.g. house, button) or drags and drops an object onto another (e.g. family member to a house). While using the service, the customer undergoes four distinct phases, and in each of them he or she is asked to indicate certain pieces of background information of his or her life situation. These phases comprise: 1) Accommodation; 2) Family members; 3) Assets; and 4) Activities. In order to provide a picture about the “concrete looks” of the “insurance cover evaluator”, the second phase (family members) is illustrated in figure 2.

Figure 2 “Family members” window (adapted from Ahonen and Salonen 2005, 40)

After going through all the four phases of the selector function, and thereby, indicating the background information related to the customer’s life situation, a suggestion for the appropriate insurance cover customized according to the indicated life situation is provided to the customer. In this phase the customer sees all the selections he or she has indicated, and the suitable insurance products that are recommended for all the selected items (e.g. house, family members, assets, and activities).

Moreover, the insurance products included in the recommended insurance cover solution are prioritized to primary insurance products and secondary insurance products according to the extent of their relevance for the customer. Primary insurance products refer to the most common and, therefore, highly recommended insurance types for the indicated living environment (e.g. car insurance, home insurance, and travel insurance). Secondary insurance products refer to more optional types of insurance (e.g. all-risk car insurance, health insurance, and sports insurance) which might be useful for the indicated living environment in case the customer desires to be fully covered against possible risks by means of insurance.

All in all, the most fundamental purpose of the “insurance cover evaluator” is to lower the barriers of electronic insurance operations for the customers by making the service environment more comprehensible and appealing. This is carried out by visualizing the service environment and insurance information to some extent.

Now the research perspective and the applied development perspective are discussed. Representatives within the insurance sector obviously are more than interested to know how this kind of service idea, or concept, can be applied to practice, or can it? The answer is yes it can be implemented in practice, and it has actually been done already.

Pohjola, the second biggest non-life insurance company in Finland which is nowadays a part of the OP-Pohjola Group, launched their “insurance selector” electronic service concept on the Internet for consumers in July 2006. Pohjola also was one of the participators in both eInsurance projects. The logic of “insurance selector” is actually based on “insurance cover evaluator” service concept developed in the first eInsurance project.

As far as I am concerned the “insurance selector” can be considered as the first real example of the functioning visual electronic insurance service at least in the Finnish scale. According to the representatives of Pohjola, their customers have been particularly satisfied with the “insurance selector”.

To encapsulate the discussion above, it can be stated that a development path including the above discussed three phases (theoretical, applied development, and practical implementation) is certainly a feasible model to be used also within the insurance industry. So far the development work has often been conducted in an individual organization and mainly referring to the last of the three development steps only. However, extending the scope of the development work to also embrace more research-oriented aspects may well lead to more innovative results as the discussion above establishes. Moreover, including fresher and lighter elements that are closer to the customers’ mindset to the electronic insurance service environment is one solution to make electronic insurance service operations more comprehensible and appealing from the customers’ point of view.

Concluding Remarks

During the ongoing decade the service economy has become more ‘electronized’. People (i.e. customers) have become more skilled and more aware users of electronic services. In this regard, customers even expect that they are provided with possibilities for getting their service needs fulfilled through the electronic service channel by the service providers.

Also in insurance context such development has emerged. However, the complex nature of insurance in general is also present in today’s electronic insurance services. Combined with somewhat high requirements for support and assistance in the self-service environment, developing electronic insurance services and the overall service environment in a way that they are closer to customer’s mindset is a particularly challenging task.

Nevertheless, new development tendencies have gained ground in the electronic service environment, also in the insurance context. In addition to being easy to use, enjoyment and pleasure are established as important features of development as well (e.g. Moon and Kim 2001; Huang 2005; De Wulf et al. 2006). The discussion above shows that it is possible to include fresher and “non-insurance like” elements, such as visualization, to the service design and development in order to generate more comprehensible and appealing service solutions for the customers who are operating in the electronic environment that is based on self-service logic.

Moreover, more visual interface brings insurance matters, which are often perceived as complex by the customers, closer to their mindset. At this point it has to be emphasized, however, that insurance should also create trust among customers, and too lively and playful elements may decrease customers’ trustworthiness towards insurance services as well as the provider of those services as a whole. Nevertheless, according to a recent study visualization, and thereby elements referring to playfulness and pleasure, does not decrease trustworthiness if the main purpose is to support the service content, not just acting as an additional entertainment on the Web sites (Ahonen 2007). Furthermore, as is established above research and collaborative applied projects may well lead to more innovative solutions in service development than projects carried out in an individual organization. This is especially the case when it comes to the idea generation phase of service design and development projects. One of the most crucial reasons behind refers to the fact that the scope for approaching the overall development work becomes more extensive, and enables “outside of the box” thinking.

Since it is important from the customers’ point of view that electronic services would be more comprehensible and appealing, this article hopefully engenders new thoughts and ideas for service design and development within the insurance sector. Furthermore, the author hopes that the discussion encourages service developers to take steps towards new, more visual and customer-friendly service solutions also from the perspective of practical implementation. In this regard, paying attention to research and collaborative working practices should not be ignored. Instead, for the sake of innovativeness such methods are even recommended.

References

Ahonen, A. (2007). From Complex to Simple: Designing a Customer-Friendly Electronic Insurance Servicescape. Academic dissertation, Finland: Tampere University Press.

Ahonen, A., & Salonen, J. (2005). eInsurance -Kohti asiakaslähtöisempää sähköistä vakuutuspalvelua, [eInsurance - Towards A More Customer-oriented Electronic Insurance Service] (Research report). Tampere: VTT Industrial Systems.

Bitner, M.J., Ostrom, A.L., & Meuter, M.L. (2002). Implementing Successful Self-Service Technologies. Academy of Management Executive, 16 (4), 96-109.

De Wulf, K., Schillewaert, N., Muylle, S., & Rangarajan, D. (2006). The Role of Pleasure in Web Site Success. Information & Management, 43 (4), 434-446.

Huang, M.H. (2005). Web Performance Scale. Information & Management, 42 (6), 841-852.

Järvinen, R., Eriksson, P., Saastamoinen, M., & Lystimäki, M. (2001). Vakuutukset verkossa – Vakuutusyhtiöiden tarjonta ja kuluttajien odotukset [Insurance on the Web – The offerings of the insurance companies and the expectations of consumers]. (Research report No. 7). Helsinki: National Consumer Research Centre.

Järvinen, R., Lehtinen, U., & Vuorinen, I. (2003). Options of Strategic Decision Making in Services: Tech, Touch, and Customisation in Financial Services. European Journal of Marketing, 37 (5/6), 774-795.

Moon, J.W., & Kim, Y.G. (2001). Extending the TAM for a World-Wide-Web Context. Information & Management, 38 (4), 217-230.

Vroomen, B., Donkers, B., Verhoef, P.C., & Franses, P.H. (2005). Selecting Profitable Customers for Complex Services on the Internet. Journal of Service Research, 8 (1), 37-47.