The discussion about what constitutes “Best Practice” in actuarial loss reserving often concentrates on the choice of the “right” calculation method. Best practice, however, should not only focus on applying the most appropriate actuarial method, but should also give equal importance to data management, reconciliation of data to balance sheet figures and a review of results by peers not involved in the calculation process, and last but not least the documentation of this actuarial estimate. After all, best practice also comprises the documentation and transparency of results as well as the underlying processes. This article sets out to describe a best practice loss reserving process.

A Best Practice Loss Reserving process consists of the following five documented and quality assured main processes:

1.Data management

2.Selection of actuarial methodology

3.Consideration of qualitative information from underwriting, claim and reinsurance departments 4.Independent quality assurance of results (“peer review”)

5.Use of actuarial results in the balance sheet Implementing these processes around loss reserving will assist companies in fulfilling internal control and transparency requirements, irrespective of accounting standards.

1. Data Management

The first step in a best practice loss reserving process is the review of the provided dataset for completeness and consistency (“reconciliation”). The provided dataset forms the basis of the loss reserving process and should consist of the following development triangles and information:

• Development triangles for paid claims

• Development triangles for case reserves

• Development triangles for IBNR

• Development triangles for number of claims

• Development triangles for Allocated Loss Adjustment Expenses (ALAE)

• Development triangles for subrogation

• Premiums

• Number of treaties

These development triangles should also be available for closed, open and reopened claims. The data should be split by direct and indirect business, gross and net of reinsurance or ceded data. A more detailed listing of the data necessary for an actuarial loss reserving analysis can be found in the publications of most actuarial associations.

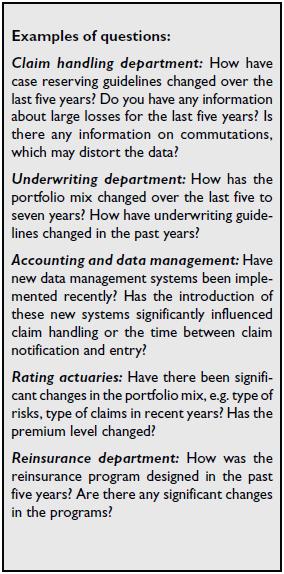

Best practice also requires that the actuary should be provided with a broad range of qualitative information from the underwriting, claim and reinsurance departments; such as initial expected loss ratios, information about the current market situation, large loss information, tariff changes and commutations. If the actuary does not typically receive such information, s/he must have access to it. If, however, this information is simply not available, the company actuary needs to actively intervene to rectify the situation and be involved in setting up a structured data process.

In this regards not only the “theoretical” availability of data is important. It is crucial to clarify what data are actually available in a company. Actuarial practice shows that, at this point, it is critical to make a distinction between “existing” and “available” data and also to clearly define what is meant by “available”. In a best practice context, “available” means that the required data, including the appropriate documentation, can be provided electronically in a short period without generating a significant amount of additional manual work.

As indicated best practice also requires that the data provided is reconciled with audited figures of the annual reports. This ensures that the data the actuary receives cover the entire business.

2. Use of Actuarial Methodology

The reconciled data form the basis for the application of actuarial methods. There is a large variety of accepted methods for estimating the ultimate loss. Expert publications discuss the advantages and disadvantages of each method.

Best practice requires the actuary to use several methods simultaneously in order to form an opinion about the stability of results under different approaches. The actuary should always use methods based on paid and incurred claims data at the same time. However to derive the ultimate estimated loss and thus the loss reserve, it is important that the actuary selects an appropriate set of methods.

However, the choice of method may already be restricted by the availability of data. This, in turn, normally limits the meaningfulness of the reserve analysis. For example, if there is no information available on incurred claims data, or if this information has been distorted by events about which no further information is available, results based on incurred claims methods are likely to be unreliable and less meaningful.

Using multiple methods in parallel allows the actuary to verify the results of the selected method. Typically the actuary should not recommend a claim reserve derived by a method which, compared to other methods, provides an extreme value (i.e. highest or lowest estimate) without further analysis. (See Example next page)

At this point, other methods indicate that perhaps

• not all information has been properly considered

• abnormal effects are included in the data, which eventually need to be re-evaluated

• the selected method consistently over- or underestimates the results

• the selected method is too volatile based on the quality of the data

These are just a few examples of effects which might be included in the data and which need to be given the appropriate actuarial consideration.

Once the analysis is complete, the actuary may well select methods which produce the highest or lowest estimate. However this selection should be well-grounded on all available information, it should be well-documented and consistent in the arguments for and against it.

This leads us to the conclusion that best practice must comprise complete, clear and comprehensible documentation. Quality assured documentation of the loss reserving processes is often neglected. The documentation of the process should be written in such a way that an independent actuary who was not involved in the analysis can understand how the results of the analysis were derived.

It is this documentation and how the actuarial results are communicated outside the mathematical departments which increase the credibility and understanding of the results in other departments. Open and comprehensive communication is an integral part of the actuarial process.

3. Consideration of qualitative information from underwriting, claim and reinsurance departments

For the actuary it is not only important to have knowledge about actuarial theory. Qualitative information from underwriting, claim and reinsurance departments are equally important. Combining numeric approaches with knowledge about the current underwriting situation and claim events help the actuary improve his/her understanding of the business and therefore support the consideration of this information in the analysis. It is then much easier for the actuary to make appropriate allowances for rate changes, large losses and so on in the selection of methods.

Involving key people from underwriting, claim and reinsurance departments in the loss reserving process is crucial for the actuary to understand the peculiarities of the underlying business and data. Interviews with relevant individuals constitute a key element of the best practice process. Open and active dialogue at this stage is not only desirable but necessary.

4. Independent quality assuarance of results ("peer review")

To ensure that all the information was evaluated appropriately, the actuarial results should be reviewed by an independent actuary; i.e. one who was not involved in the analysis.

This quality assurance of the analysis is an important step in a best practice process. It reinforces the credibility of the results. The use of information as well as the technical details of the analysis are reviewed and – if necessary – discussed with the reporting actuary. The reviewer will analyse the results in light of his/her own background and practical experience. This may introduce a different point of view to the analysis and thus not only assures the quality of the results but also generally improves it.

At this stage it can be of much help to involve external independent actuaries. Independence has gained in importance in the light of Sarbanes-Oxley. It is important to note that the involvement of external actuaries does not mean that management does not trust its internal actuaries, but rather that an additional external, independent point of view is valuable in the reserving process. As mentioned, the loss reserving process is open to a wide variety of actuarial judgements and evaluations. An external actuary provides another point of view and is able to assess the chosen approach from a broader market perspective.

S/he will provide constructive challenge of established processes and methods for evaluating the quality of the analysis, and if necessary, question these.

5. Use of actuarial results in the balance sheet

After the actuarial analysis is completed, a report is made available which forms an important basis for accounting. To set the balance sheet reserve, best practice recommends setting up a reserving committee. This reserve committee could, for example, have as its members the heads of claim, underwriting and actuarial departments as well as the CFO and the CRO of the company. Based on the actuarial analysis, the qualitative information as well as the overall objectives of the company the reserving committee agrees on an adequate balance sheet reserve.

In practice, this often looks quite different. At the moment very few property/casualty actuaries have either a formal or obligatory role in the reserving process or a legal responsibility in setting loss reserves with the exception of annuity reserves. For annuity reserves, the Responsible Actuary has legal obligations. In the European markets, the executive board has a legal responsibility for setting loss reserves. That means for the actuary that s/he merely recommends a risk adequate loss reserve (“Best Estimate”). At the end of the process it is up to the board of a company to decide whether or not to follow this recommendation.

Solvency II: Best Practice in Loss Reserving ...

It is now up to the actuary to convince the members of the reserving committee that the resulting loss reserve represents the best estimate. At this stage the documentation is a crucial part of this process as it documents the selected assumptions and methods. If, after reviewing all information, the reserve committee decides that the recommended reserves need adjusting, it is the executive board which is currently responsible for this decision. Under a Corporate Governance framework, management decisions to adjust loss reserves must be thoroughly documented.

Conclusion

For direct insurers and re-insurers, the role of actuaries in loss reserving is becoming increasingly important. Estimating risk-adequate loss reserves is a complex processes requiring in-depth knowledge of current best practice in the industry. The implementation of best practice processes as detailed throughout various areas of a company forms an important part of Solvency II, both Pillar 2 (the Supervisory Review Process and internal controlling) and Pillar 3 (transparency and market discipline).