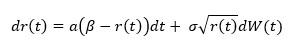

Insurance companies use different types of interest rate models for the same type of valuation, the valuation of the time value of options and guarantees (TVOG). This paper aims to explain and examine the impact of using the following underlying interest rate models: Hull and White (HW); Cox–Ingersoll–Ross (CIR); and Libor Market Model (LMM) when generating the economic scenarios used for the valuation. These three processes are all used in the insurance industry and fulfill to a certain extent the market consistency and risk neutrality required by EIOPA under Solvency II.

The differences in their distributions yield different results when the TVOG is determined, which indicates the importance of using the appropriate model as well as understanding it. The TVOG is significantly different for products with a guaranteed rate of 0% due to the allowance of negative rates in HW.

Find the full article below (pdf).