With the re-election of George Bush, the debate around privatization of Social Security in the United States has been rekindled. The Republicans favor separating a part of OASDI to be moved into Individual Retirement Accounts. Some have suggested more radical reforms such as moving OASDI entirely from a Defined Benefit (DB) scheme to a Defined Contribution (DC) plan based on the Chilean model.

Canada has moved to a system of greater pre-funding for the Canada/Quebec Pension Plans (C/QPP) in order to cap contribution rates at 9.9 percent. These proposals have the goal of creating higher investment returns, to make social security benefits more affordable.

The important public policy issues inherent in such proposals are numerous: is pre-funded social security demographically immune; does pre-funding social security increase gross national savings and worker productivity; are there better ways to create a healthy economy; is social security best offered as a DB or DC plan? This paper reviews these important issues in the context of recent social security policy initiatives in Canada and the U.S.

After extensive review, the paper concludes that greater pre-funding of social security will not, of and by itself, create a more secure system.

I. Introduction

This paper discusses the issues surrounding the financing of social security in Canada and the U.S., but the discussion has public policy implications around the world. The paper critiques moves toward greater pre-funding of social security. There are numerous authors who speak in favor of greater pre-funding

(e.g., Robson, 1995, World Bank, 1994, Taverne, 1995, Pesando, 1997, and Ferrara and Tanner 1998). The purpose of this paper is to pose important questions that need to be answered by policymakers before any further moves are made toward greater pre-funding of social security. Actuaries and economists, by their training, have a natural pre-disposal to favor pre-funding. As stated by Miles Dawson (1917):

... actuaries approach it as if it were settled in advance that there ought to be a reserve and after a good deal of study and investigation are not so certain they are right.

The reason for this is that actuaries tend to work with private sector pension plans which must be fully funded. This is because, no matter who is the sponsor, any company can cease to exist at any time which could leave an under-funded pension with future promised benefits that cannot be paid. This is not true of

social security, however. By definition, the government will always be there to see that future promised benefits are, in fact, met with actual benefits. If your government ceases to exist, you have bigger problems than the financial health of your social security system. Thus, it is misleading to create analogies between private pensions and social security. They are remarkably different.

Proposition 1:

Social Security is not a large private sector pension. It is instead, a macroeconomic means of wealth transfer, where workers transfer wealth to the elderly through their social security contributions. This is true whether the plan is pre-funded or pay-as-yougo.

The meaning of the words pay-as-you-go (paygo)and fundedneed to be carefully understood. Neither word is taken at its absolute. For example, paygo funding does not mean no contingency fund at all. A system carrying a small contingency fund is considered paygo. Similarly, funded does not mean absolutely fully funded. A partially funded scheme that has investable funds measurably larger than a small contingency reserve is included in the category of “pre-funded” .

Until recently, both the Old Age, Survivors and Disability Insurance (OASDI) system in the U.S. and the Canada/Quebec Pension Plans (C/QPP) in Canada were paygo. However, that is not true today. In Canada, 1996 government amendments raised the C/QPP contribution rate from 6.0 percent to 9.9 percent to create a fund worth five years of benefit expenditures. In the U.S., the maximum value of the OASDI ‘fund’ will be $2.4 trillion in 2016 (Intermediate Projection, OASDI Trustees Report, 2005). Thus, neither OASDI nor the amended C/QPP would be referred to as purely paygo today.

Any social security system will have mandatory worker contributions and a set of promised benefits. To determine the key variables in setting the required contribution rate, we outline two equations.

First, we have the equation necessary for an Individual Account system where each worker provides for his/her benefits and benefits are indexed to the cost of living (e.g. Consumer Price Index). For every dollar of benefit expected at age 65, the required contribution is:

assuming contributions start at age 20

where: δ is the real rate of interest earned on the invested funds, after inflation (both before and after retirement) and l is the life table 1x survivorship probability.

Normally, mortality is relatively easy to predict on a macro-economic basis (although it is not for any individual). Thus, for the contribution rate for an Individual Account system one variable is life expectancy, but the most important variable is the rate of return on invested assets.

The parallel equation for a pure paygo system where no investment income is earned is:

where: r is the rate of increase of national wages on which contributions are made and Lx is the actual number of people in the system aged x.

Thus, we can see that a paygo system is very dependent of the ratio of retirees to workers, and on the rate of increase in covered wages.

Covered wages are, in turn, very dependent on the growth rate of the recognized labor force

(i.e. there may be an underground or cash economy) and the productivity of workers. A cash economy can create significant difficulties for social security, especially if such a system guarantees minimum benefits for very little in contributions which is true in many developing countries.

Assume the ratio of retirees to workers doubles in one generation (say 35 years). This would create a problem for the associated social security system. But assume that workers were to become more productive by 2.0 percent per annum. Then, in theory, workers could support this doubling of the Dependency Ratio with the same total contribution and tax rate (all else equal) since, at 2.0 percent per annum, productivity would exactly double in 35 years.

Proposition 2:

The contribution rate required for fully-funded social security is highly dependent on the real rates of return earned on invested assets. The contribution rate required for paygo social security is highly dependent on the ratio of dependents to workers and the rate of increase in covered wages. The latter, in turn, is dependent on the growth rate of the labor force and the growth rate of worker productivity.

One argument often used to support fuller funding is the stability of contribution rates. As discussed, the contribution rates for a fully funded scheme are a function of the real rates of return earned by the funds. Thus, a truly fully funded scheme does not create stable contribution rates. Contribution rates rise and fall inversely to real interest rates.

On the other hand, a pure paygo system has contribution rates that rise and fall with the ratio of retirees to workers and the rate of increase of (contributory) national income. Thus, a pure paygo system also cannot expect long-term stable contribution rates.

Security for Social Security:Is Pre-Funding the Answer?

Proposition 3:

There is nothing inherent in the mechanisms of fully-funded social security to make it any more stable than a paygo system.

Both financing extremes would require immediate attention if any variable evolves other than the modeled expectations. However, both a paygo system with a small contingency fund or a partially funded system that does not have to be exactly fully funded can achieve stable contribution rates for long periods.

One must also be concerned about the political stability of the sponsoring government. In countries like Canada and the U.S., this is not a problem, but in countries with corrupt governments, it is.

Proposition 4:

In a country with a corrupt government, the only thing riskier to workers than a paygo social security is a funded system.

In a paygo system, the corrupt government officials can only abscond with the social security liabilities in the middle of the night. However, if the system is fully funded, they can abscond with the assets. It is one thing if retirees suddenly find that they are not going to get the benefits they were promised. However, it is worse to lose real assets.

II Advantages of Paygo Financing

While paygo financing has the disadvantage of being demographically sensitive, there are several advantages of such schemes.

1.The entire working population can be covered relatively easily and immediately.

2.Because contribution income immediately becomes benefit payout, benefits can be indexed to wages. In fact, there exists a source of ‘actuarial discounting’ for years with real productivity gains if benefits are indexed to cost of living and contributions are indexed to average wages (the norm). Indexation is not feasible for Individual Accounts.

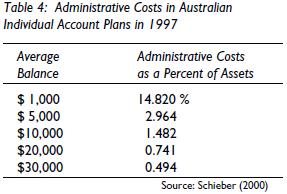

3.Administrative costs are usually very low per unit of cash flow, much lower than for private plans. Plus, Individual Account expenses are always larger for smaller balances leading to a regressive system.

III. Why the Interest in Greater pre-funding of Social Security?

After a half century of relative stability in the financing design of social security, why the apparent sudden interest in fuller funding?

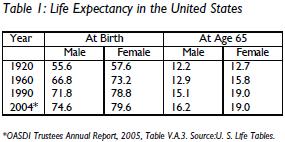

One of the driving forces for reform is the impending dramatic shift in demographics. First, life expectancy has improved substantially and is continuing to improve. Statistics for the U.S. are given in Table 1.

More important are the well known impending dependency shifts as the baby boom moves out of the labor force and into retirement to be replaced by the baby-bust.

Those who favor pre-funding of social security argue that the resultant large asset pools can be invested to aid in overcoming the impact of these demographic shifts. Through enhanced economic growth, faster wealth creation makes larger wealth transfers possible. For example, assume that the cost of social security today is 10% of all wages. That means that a worker has to allocate all of his/ her production on Monday morning to the dependent elderly. Assume that over the next 35 years the ratio of elderly to workers doubles. With no change in worker productivity, each worker would have to contribute 20% of wages, or work one whole day, to fund the benefits for the dependent elderly. However, if every worker becomes twice as productive (a 2% per annum improvement), then each worker would produce enough to meet the needs of the elderly in the same half day.

If pre-funding social security results in faster wealth creation, then why wasn’t social security established on a fully funded basis? There are several reasons. First, paygo financing allows for significant benefits to citizens already retired at the inception of the plan (or soon to retire). Full benefits under a fully-funded system can take up to 40 years to accrue. Second, with no assets, there is no danger of the government influencing the economy inappropriately through the use of the social security funds. (“socialism” through the back door).

If social security is financed on a paygo basis, then the ‘rate of return’ is the rate of increase of covered employment earnings. Fully-funded schemes have a discount rate equivalent to the real rate of interest (real rates because benefits are indexed to inflation).

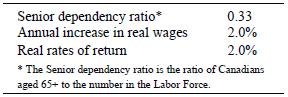

According to the Canadian Institute of Actuaries (CIA, 1996, p.3), in the 1960s, long-term demographic and economic variables favored paygo financing. In particular, in the 1960s in Canada, reasonable actuarial assumptions would have been (ibid.):

These underlying assumptions would have led to the following projected costs for Canadian social security as a percentage of payroll.

Funding Projected Cost as Arrangement Percentage of Payroll

Thus as Keith Ambachtsheer stated (1995): Just as pay-go financing makes sense when real interest rates are lower than real GDP growth prospects (i.e. the mid-1960’s), so a conversion to pre-funding makes sense when real interest rates are higher than real GDP growth prospects (i.e. the mid-1990’s).

Proposition 5:

The fact that both of the major North American social security systems were started as paygo was not a mistake. Further, just as funded systems may make more sense today, it is entirely possible that economic variables could shift and once again favor paygo financing.

As the CIA report “Troubled Tomorrows’’

(CIA, 1995, p. 23) wisely concluded: Should Canada abandon the pay-as-you-go approach? We think not. No retirement income system—funded or unfunded, public or private—is free from risk. Any attempt to fund or replace Canada’s public pension plans will be expensive in the short term, with no

Security for Social Security:Is Pre-Funding the Answer?

guarantee of a commensurate reduction in long-term cost. Today’s environment favours funded retirement savings plans, but tomorrow’s environment, like the environment of the 1960’s might not.

But is a pre-funded scheme more secure? How long will factors favoring pre-funding last? Can productivity rates be increased by pre-funding social security? Are pre-funded plans demographically immune (i.e. could fully-funded plans provide promised retirement benefits to the baby boom purely from the funds on hand regardless of the size of the labor force in the next generation)? We now explore these issues.

IV. Is a Funded Scheme Demographically Immune?

The most serious challenge for paygo financing is the rapidly shifting ratio of retirees to workers. Would a fully-funded system be demographically immune?

One of the problems that exists with any discussion around optimal financing is confusion between what is true micro-economically (i.e. for one person) versus macro-economically (e.g. in an economy as large as the U.S.). This is sometimes referred to as the Fallacy of Composition. [see Barr (1993) and Krugman (1996)]. For example, if I stand at a concert, I can see better, but if everyone stands, then no one has an improved view. For an individual to save for retirement, consumption must be foregone during one’s working life, with money set aside in savings. These assets are then sold post-retirement and the money used to buy goods and services. This system appears to be workable regardless of the ratio of retirees to workers since every worker funds his/her own benefits in full. Can this logic be projected to a fully-funded social security scheme?

Francisco Bayo (1988, 178) Deputy Chief Actuary of OASDI says “no”:

For Social Security, you cannot accumulate assets; that is, claims from somebody else’s production. If we have a large amount of money in the Social Security trust funds, we have a claim on ourselves, which does not have much meaning. The truth is, whatever is going to be consumed—be it a product that you can get a physical hold of, or services that are very difficult to hold—those products cannot be stockpiled. They have to be provided at the time of consumption. No matter what kind of financing we are going to have in our Social Security program, you will find that the benefits that will be obtained by the beneficiary in the year 2050 will have to be produced by the workers in the year 2050, or just a few years earlier.

Nicholas Barr (1993, 220) says it even more

strongly: The widely held (but false) view that funded schemes are inherently ‘safer’ than PAYAS-YOU-GO is an example of the fallacy of composition. For individuals the economic function of a pension scheme is to transfer consumption over time. But (ruling out the case where current output is stored in holes in people’s gardens) this is not possible for society as a whole; the consumption of pensioners as a group is produced by the next generation of workers. From an aggregate viewpoint, the economic function of pension schemes is to divide total production between workers and pensioners, i.e. to reduce the consumption of workers so that sufficient output remains for pensioners. Once this point is understood it becomes clear why PAY-ASYOU-GO and funded schemes, which are simply ways of dividing output between workers and pensioners, should not fare very differently in the face of demographic change.

Thus, pre-funded systems do not overcome

the impact of demographic shifts. (The paper

discusses the countervailing impact of foreign

investment later). The pension income of any

decade must come out of the national income

of that decade.

Proposition 6:

A fully-funded social security system is not demographically immune. A fully-funded system is as dependent on the next generation of workers and their productivity as a paygo system.

However, there may be other reasons to consider a pre-funded scheme as advantageous.

V. Does Pre-funding Social Security Increase Savings and/or Productivity?

Barr (1993, p.223) admits that declines in the working aged population can be offset by increased productivity amongst the remaining workers or by increased labor force participation rates (e.g., among women), so long as output is maintained. It is also possible to maintain the consumption of both workers and pensioners with goods produced abroad, provided the country has sufficient overseas assets to do so.

The crucial variable is output. A decline in the labor force causes problems for any pension scheme only if it causes a fall in output; the problem is solved to the extent that this can be prevented. The choice between PAYGO and funding in the face of demographic change is therefore relevant only to the extent that funding (as is sometimes argued) systematically causes output to be higher (ibid.).

Thus, we have two important truths. First, no pension plan, private or public, funded or paygo, is demographically immune (see Schieber and Shoven 1996). Second, the real security behind any pension plan is a healthy economy. Wealth cannot be transferred until it is created. And the more wealth that is created, the easier it is to transfer some to the retired elderly.

Security for Social Security:Is Pre-Funding the Answer?

Proposition 7:

For pre-funding to have any impact on the security of social security, three requirements must be satisfied (all three); namely:

Pre-funding must increase gross national savings.

Those increased savings must be invested so as to increase worker productivity.

The pre-funding must be the best way to achieve the first two requirements.

If there is an alternative policy that can increase savings and productivity more effectively, then it should be the preferred method. Is pre-funding the preferred route?

Does the pre-funding of social security increase gross national savings (versus, for example, increased hoarding or increased surplus on the current accounts)? There is an abundance of literature on this topic [for example, see Ricardo (1817), Daly (1981), Aaron (1982), Barr (1993), Burbidge (1987), Atkinson (1995), Hughes (1996), Feldstein (1996)], but no clear conclusion. This turns out to be a very difficult question if you allow for behavioral response (or Ricardian equivalence).

Of importance here is the replacement ratio provided by social security. In both Canada and the U.S., a worker consistently earning the average industrial wage will realize a replacement ratio of about 40% from social security. Poorer workers get more, wealthier workers less. Hence social security does not provide full retirement income security—far from it. Thus, other forms of savings are essential. In these systems, fuller funding of social security may cause workers to reduce their personal savings and lead to a zero-sum game.

In Chile, in 1980, when social security was financed on a paygo basis, the gross national savings rate was 21.0%. In 1981, Chile introduced mandatory Individual Accounts with 10% contributions. The Chilean gross national savings rate dipped substantially in the early 1980s, and stood at 18.8% until 1991 (Uthoff 1993). Holzmann (1997) finds empirical evidence of both increased national savings and enhanced worker productivity in Chile after the 1981 social security reforms. However, he concludes that:

The direct impact of the (social security) reform on private saving was low, or perhaps even negative.

According to Holzmann, the increase in savings and productivity were because of higher

growth rates in the economy not social security reform.

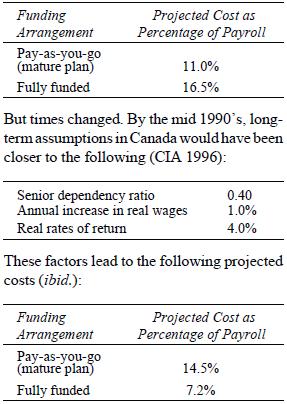

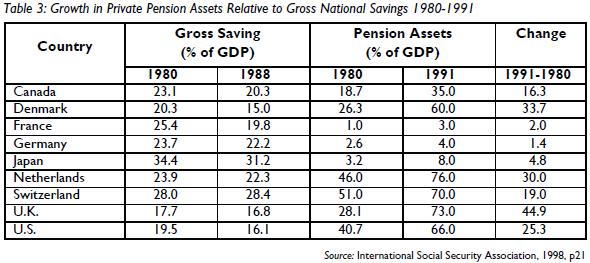

Hughes (1999, p51) lists “Pension Assets/ GNP” versus “National Savings/GNP” for sixteen countries, and finds that there is no correlation between pension assets and Net National Savings at all. This is supported by work done by the International Social Security Association (1998, p21) in Table 3.

Further, if there are tax incentives for funded pension plans, any increase in national savings may be offset by a drop in tax revenues (Hughes, 1999, p58).

Even if gross national savings are increased, are these savings invested in a manner that increases worker productivity?

Again, the literature is inconclusive. For every plan that seems to create a healthier economy, there are examples where funds are used for purely political purposes, to reward political friends, to prop up failing industries, or even straight fraud.

Finally, even if the answers to our first two questions were positive, should greater pre-funding of social security be the preferred policy option? Aaron (1982), after lengthy analysis of the U.S. savings rates and labor force participation rates from 1930 to the late 1980s, says no.

If our objective is to increase the rate of capital accumulation, we should ask which instruments are best for achieving that end. Prominent on the list would be direct assaults on the federal deficit, incentives to business investment, and the withdrawal of incentives that promote inefficient investments...I conclude also that if we wish to increase capital formation, the proper objective is the total saving rate, and that raising social security payroll taxes or cutting social security benefits is a poor device for achieving that objective unless we favor them on other grounds. (Aaron 1982, p. 51-52)

Proposition 8:

There exists no evidence that the best way to increase national savings is to move to fully-funded social security. A better first step would be to pay down the national debt.

VI. Other Design Issues

A wide variety of proposals for pre-funding social security exist. We now review some of these and outline their advantages and disadvantages.

A. Keep a Defined-Benefit (DB) Design, but with Greater Pre-funding

Keeping a DB design has the advantage that all workers share in the risks, including inflation, mortality, investment rates, and interest rate risk at the time of buying an annuity. Further, one can easily include ancillary benefits such as disability income and survivor income benefits.

However, the establishment of larger pre-funding creates associated problems. First, to the extent that the assets are invested in government bonds, has anything changed versus paygo? Workers are both social security contributors and taxpayers, and it is doubtful that they care about the use of their payroll deductions, only the total. As social security buys government bonds, governments can use these funds to finance expenditures and allow lower tax rates. Thus, higher social security contributions are balanced by lower tax rates. The total, however, has not changed as to size or timing.

Similarly, when the baby boomers start to retire, social security must sell its bonds. While social security contribution rates may not have to rise, taxes will have to be raised to pay off the redeemed bonds. Again, the total burden is exactly the same, in both size and timing, as under paygo financing.

Security for Social Security:Is Pre-Funding the Answer?

Proposition 9:

Macro-economically, there is very little difference between paygo social security and a funded system where all assets are government bonds.

In reality, the financing is still paygo. In fact, pre-funding with bonds may work against creating a more productive economy if these funds are merely used by the government to finance deficits based on consumption-targeted spending (e.g., welfare payments). This may be especially true in the U.S. where the OASDI annual surplus is included in the unified federal budget and can be used to mask deficits.

B. What if the Funds are invested in Private-Sector Assets?

First, we may end up in a zero-sum game. If social security buys corporate debt and equities, but the private sector commensurately decreases its purchase of corporate debt and equities and substitutes (say) government bonds, then nothing may have changed in total.

If the result is not a zero-sum game, then presumably governments have to find new financing for their debt. One would thus expect higher bond interest rates to result. Ultimately, these higher interest charges fall back onto workers as increased taxes.

Other issues need to be addressed. Who will decide how these assets are invested? Could the funds be used for political purposes, for lemon-aid (e.g., to prop up ailing industries), or will they improve productivity? Can avoidance of political influence be guaranteed? Should the investment of these assets be restricted to the domestic market? If so, will that not mean that the government will have an undue influence over domestic capital markets?

What if the investing is done passively, to achieve an index rate of return? Can the capital markets remain efficient if the majority of investment funds are passively invested? Such funds follow the market rather than leading it. Private capitalism works because management is forced by stockholders to excel. How do purely passive funds cause such excellence?

Are there enough high-quality assets available to invest wisely the trillions of dollars that will become available? The assets of funded social security will build up rapidly as the baby boom pre-funds it benefits. However, the same baby-boomers will also be saving on their own for the remainder of their retirement needs. Thus, it could be argued that the social security system will be buying when asset values are high.

Then, when the baby boom retires, it will force the liquidation of the social security funds at the same time as they are liquidating their other retirement plan assets. As stated by Schieber and Shoven (1996):

This could depress asset prices, particularly since the demographic structure of the United States does not differ that greatly from Japan and Europe, which also will have large elderly populations at the time.

Thus, a pre-funded system may be doomed by buying high and selling low. At the very least, the high rates of return now projected by supporters of privatization may not accrue and their costing projections may prove unachievable. The move to pre-funding is grounded on the assumption that real rates of return will continue to exceed the growth rate in real wages. If that weren’t true, then paygo financing would be preferred. However, can we continue to expect the current high real rates if we create trillions of dollars of new gross national savings that are then liquidated over time as the baby boom retires?

Offshore investment might be preferable for at least three reasons. First, the domestic market may not be large enough for the prudent investment of such large funds. Second, diversification of risk in any portfolio is generally advised. Third, by investing in countries that do not share the same aging populations (e.g., developing nations), it might be possible to dampen the impact of our shifting demographics. This could be viewed as demographic profile diversification.

However, this is not without some significant investment risk, currency exchange risk and political risk. One could expect heated debate if social security were to build up large investable funds, and then invest them heavily offshore.

There are other problems associated with pre-funded systems. First, pre-funded schemes are exposed to the risk of unforeseen inflation (if it decreases real rates of return) because of the length of time between contribution and payment of retirement income. In this regard, inflation nearly destroyed several funded schemes in Europe earlier in the 20th century (e.g., France and Germany). This may be one reason that these schemes now use close to paygo financing. Pre-funded provident funds also have experienced problems with inflation.

Second, with the creation of large investment funds, there will be strong and continuous pressure to expand social security benefits just when such expansion would be misguided. The history of the C/QPP provides strong evidence for this. Because of low early contribution rates and a healthy contingency fund, politicians steadily increased the benefits of the C/QPP during its first 25 years.

Finally, the creation of funds to invest requires that social security contribution rates must be set higher, in the short run, than those required under pure paygo. Is this optimal public policy? Perhaps not.

First, there is evidence that social security contributions hurt job creation.

[In Canada] These [social security contribu

tion rate] increases have had and will con

tinue to have a negative impact on the labor force. By [between 1986 and] 1993, the rise in contributions by employers and employees had reduced employment and the participation rate by nearly 26,000 jobs and 0.12 percentage points, respectively. By the year 2016, the increase in C/QPP contributions will have reduced the participation rate by approximately 0.5 percentage points (Italianno 1996).

This effect is especially pronounced if social security taxes are levied on only part of the worker’s income (e.g., in Canada, C/QPP contributions are levied only up to the Average Industrial Wage). Raising contribution rates could have the effect of providing an incentive to pay for overtime instead of hiring new staff. Would it not be preferable to assist job creation now, even if it means higher potential contributions when the baby boom retires, but also when there could easily be labor shortages?

Second, social security contributions are a part of total government taxation. There must be a maximum rate of taxation beyond which actual tax receipts decline. Prior to this, resistance to increased taxation will be evident in the proportion of the economy that evades taxation (i.e., the underground or cash economy). So long as there exists government debt, is it optimal policy to increase social security funds or rather to increase some other form of tax and decrease the debt?

Mandating employer-sponsored private pensions or even creating stronger incentives (or weaker disincentives) for private pensions and individual savings could have the same effect on savings and productivity. Is it not better to concentrate on the economic goals directly, rather than attempt to achieve them as a by-product of social security financing?

The pre-funding of social security might create a higher moral claim for the generation that paid for the full cost of benefits. This argument is stronger if these new assets are invested in the private sector, versus government bonds. Through the social security system, workers would become owners of capital and could expect to receive a fair rate of return on the capital after they retire. Although this is a strong argument, it still depends entirely on this capital being new and additional and on the capital being used to enhance worker productivity. These basic truths have not changed.

C. Change Social Security to a Defined-Contribution (DC) Plan

Another possibility is to turn DB systems into DC schemes in which participants decide how their individual funds are invested. This was done in Chile in 1981 and emulated by many Latin American countries.

As to advantages, the scheme allows for universal coverage of workers, immediate vesting, and full portability. It would also, in theory, provide billions of dollars of investable funds, the potential impact of which has been discussed in detail previously. The supporters of Individual Accounts (IA) replacing DB Social Security are many (e.g., World Bank, 1994, Robson, 1995 and Ferrara and Tanner, 1998), and their arguments will not be repeated here.

There are, however, several disadvantages to DC IAs. First, where paygo schemes can

Security for Social Security:Is Pre-Funding the Answer?

create immediate benefits for the elderly, a DC scheme cannot do so for a very long time (at least thirty years).

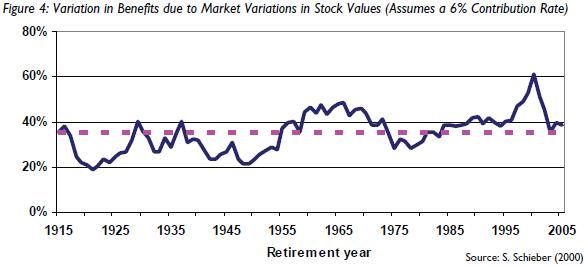

Second, all of the risks of a DC plan, including the investment risk, the inflation risk, and the longevity risk fall on the shoulders of the individual worker instead of being shared across the entire working population. As a result one should expect workers to invest in relatively low risk investments resulting in lower long-term rates of return than modeled by proponents of these reforms. This is extremely important since every 1 percent of extra return over the lifetime of a worker results in a pension that is about 24 percent larger (Adams, 1967). Schieber (2000) illustrates the risk-bearing element well in Figure 4 where he shows the replacement ratio that a worker would realize if s/he had saved 6 percent of pay each year over a forty-year working lifetime (shown by year of retirement at age 65).

Obviously, rates of interest at the time of retirement are of critical importance if the worker is forced to annuitize, as is often the case.

Third, the ancillary benefits of a DB plan (e.g., Disability Income benefits, Orphans benefits) would be lost or have to be replaced. These ancillary benefits are about one-third of

total coverage in Canada and the US. Reformers suggest that participants buy private insurance to replace these benefits. These costs are not immaterial (e.g., one-third of the existing contribution rate). Also, solutions are needed for those who cannot get private coverage.

Fourth, administrative expenses for such a scheme can be expected to run at 12 to 15 percent of cash flow (as in Chile) versus the

0.8 percent expense ratio for OASDI. Thus much of the anticipated higher gross rates of return would be lost to higher expenses. Also, these expenses can be expected to be regressive since smaller account balances will experience larger percentage expenses than larger balances. This isn’t just true in developing nations as can be seen from the following Australian data.

Fifth, there may not be enough high quality assets to match the new investable funds. In periods of poor investment returns (which are inevitable) the government may be blamed, and may be asked to provide minimum guarantees (which lead to economic distortions and possible worker selection against the system). In particular, a switch to a DC system at this time may curse workers with ‘buying high’ and ‘selling low’ as discussed earlier.

Sixth, there is no wealth redistribution in these schemes. A worker who is poor throughout his/her working lifetime is guaranteed poverty in retirement. Wealthy workers are guaranteed a wealthy retirement, aided by the significant tax advantages provided by the scheme.

Seventh, without special legislation, women would retire with lower retirement income than men of identical contribution records, because of their higher life expectancy.

Eighth, the transition generation will have to pay twice: first to fund the new DC scheme and second to pay for the accrued liability of the present paygo scheme. In this regard, remember that it will be 30 to 40 years before the new DC scheme can pay out full benefits.

This will probably result in some guarantees of minimum benefits and/or minimum investment performance under the new system (which, unless designed skillfully, can be open to abuse and anti-selection).

Proposition 10:

There is nothing in the history of any country’s social security system or in the literature that supports the view that more funding of social security leads to either:

higher national savings rates, or

improved worker productivity. Thus, one cannot conclude that reform of

social security to a more funded system is the best way to achieve these laudable goals.

VII. Portfolio Diversification

Any introductory course in risk management will preach that a primary step toward investment risk management is portfolio diversification. No investment counselor would advise putting all of one’s eggs in one basket. As stated, there are times when paygo financing can be advantageous and times when fuller funding should be preferred. There are individuals for whom DC plans are best, but also individuals who gain from DB systems. If we privatize social security, how does that fit with a goal of a diversified portfolio?

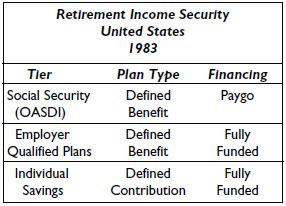

Using the U.S. as our example, we compare the diversity of their financial security systems at two times. In 1983, the U.S. had a mix of DB and DC plans plus a mix of paygo and full funding. Clearly, this is a diversified system.

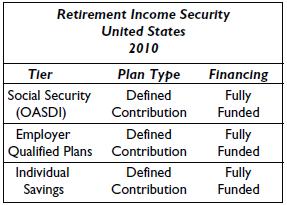

Since 1983, many U.S. Employer-sponsored DB Pension Plans have switched to DC. Today, the majority of workers are in a DC plan. If one were to classify Cash Balance Plans as DC (their classification is not easy) then that percentage would be even higher.

There is also discussion about changing the Social Security system from DB plan to DC (Individual Accounts). Depending on the outcome of the debate, as early as 2010, the U.S. Retirement Income Security System could be as follows:

Clearly, there is no diversification in this portfolio. If one believes that there are times that favor DB plans versus DC plans, and times that favor paygo financing over full funding, then this system, with “all of the eggs in one basket”, is ill advised.

VIII. Conclusion

This paper has explored issues with respect to greater pre-funding of social security. The thesis is that any public policy designed to enhance the security of social security must satisfy (all) three criteria:

It must increase gross national savings.

Those savings must be used in a manner that increases worker productivity.

There cannot exist a better method of achiev

ing the first two stated goals. The paper reviewed a variety of proposals for financing of social security and found many unanswered questions and unsatisfied concerns. In fact, there is no conclusive evidence in the literature that greater pre-funding of social security will solve the problems created by rapid population aging.

Proposition 11:

In short, proposed moves to higher levels of pre-funding of social security in both Canada and the U.S. require further public policy debate. Society should not rely on fuller funding of social security to solve the problems inherent in providing retirement income security to an aging population.

And in conclusion:

tainable long term.

2.A healthy and growing national economy. 3.An efficient and accurate records adminis

tration system. 4.An honest government.

These are not a function of how you finance social security, In fact, the method of financing social security may be close to irrelevant to its future security.

Proposition 12:

The four attributes that will provide security for social security are:

1.Contribution and Benefit rates that are sustainable long term.

2.A healthy and growing national economy.

3.An efficient and accurate records administration system.

4.An honest government.

These are not a function of how you finance social security, In fact, the method of financing social security may be close to irrelevant to its future security.

Bibliography

Adams, W. R. (1967). The Effect of Interest on Pension Contributions. Transactions of the Society of Actuaries. Vol. XIX, 170-193, Chicago.

Ambachtsheer, Keith (1995). The Ambachtsheer Letter. #157, Toronto.

Barr, Nicholas (1993). The Economics of the Welfare State, Weidenfeld and Nicolson, London.

Bayo, F. (1988). Measures of Actuarial Balance for Social Insurance Programs. Record, the Society of Actuaries. 14, (1), 161-179, Chicago. Volume 46, pp 1-32.

Canadian Institute of Actuaries (1995). Troubled Tomorrows — The Report of the Canadian Institute of Actuaries Task Force on Retirement Savings, Ottawa.

Feldstein M. (1996). “The Missing Piece in Policy Analysis: Social Security Reform. American Economic Review, Vol. 86, No. 2, May, pp 1-14.

Ferrara, P. J. and M. Tanner (1998). A New Deal for Social Security. The Cato Institute.

Hughes, G. (1996) “Would Privatising Pensions Increase Savings?” Irish Banking Review, Spring, Irish Bankers’ Federation.

(1999). The Cost and Distribution of Tax Expenditures in Occupational Pensions in Ireland. Seminar Paper, November 11. The Economic and Social Research Institute., Dublin.

International Social Security Association (1998). The Social Security Reform Debate: In Search of a New Consensus—A Summary. ISSA, Geneva.

Italianno, J. (1995). Growth in Supplementary Labour Income: Implications for Tax Revenue, Employment and Participation. Ottawa, Department of Finance.

OASDI Board of Trustees (2006). The 2005 Trustees Report. April. U.S. Government Printing Office, Washington.

Pesando, J. E. (1997) “From Tax Grab to Retirement Saving: Privatizing the CPP Premium Hike”. Commentary 93, C. D. Howe Institute, June, Toronto.

Ricardo, D. (1817). On the Principles of Political Economy and Taxation. Reprinted in 1971, edited by R. J. Hartwell. London: Penguin Books.

Robson, W. B. P. (1995). Putting Some Gold in the Golden Years: Fixing the Canada Pension Plan. C.

D. Howe Commentary, No. 76, Toronto. Schieber, S. J. (2000) Risks Involved in Privatizing Social Security. A paper presented at the Society of Actuaries Retirement 2000 Symposium, Washington D.C., Feb. 22/23 (Proceedings to appear). Schieber, S. J. and J. Shoven (1996). “Where Your Bull is?” New York Times, Sunday, March 10, New York. Taverne, D. (1995). The Pension Time Bomb in Europe. London. The Federal Trust. Uthoff, A. W. (1993). Pension System Reform in Latin America, in Y. Akyuz, G. Held, ECLAC, UNCTAD, UNU (eds). Finance and the real economy, Santiago, Chile. World Bank (1994). Averting the Old Age Crisis: Policies to Protect the Old and Promote Growth. A

World Bank Policy Research Report, Oxford University Press, New York.