There is absolutely no doubt that the tag of insurtech is rather hot in the investment world. In H1 2019 itself there is more investment on insurtech deals than the whole year 2017. There appears to have been no peaking-out or slowing down over the last 4-5 years! (1) This article has my reflection and insights on the constituents of insurtech, a snapshot of the Nordic insurtech situation and the prospects in the near future.

What is Insurtech?

Insurtech as a term is commonly used to describe any sort of steps that companies participating in the insurance value chain take towards digitization and automation. However, in order to make educated investment bets, both from the incumbent insurer’s perspective as well as from the challenger’s perspective, it is imperative to distinguish insurtech from technology innovations or simply new companies in the insurance space.

In the same context it needs to be clarified that being an insurtech or securing internal funding from an incumbent or getting access to funds from investors is simply the 1st step. It means that a few people believe the idea, the business logic and are willing (and in the classical sense- write-off) to invest. In order to be successful, the business model as well as the technology choices need to prove successful in the market.

Digitization lies at the heart of convergence between traditional insurance, new technology and business innovations (4). Karl Heinz Passler writes that traditional insurance business and its digitization are all about converting paper-based thinking to digital format (5). Thus, insurtech is about inventing new paradigms without the shackles of paper-based thinking by leveraging technology and business model innovations.

1: Credit- Karl Heinz Passler

The insurtech journey in the Nordic context is relatively in infancy stage. It is more common to see incumbent insurers investing in digitizing paper-based systems or modernizing obsolete technology stacks. It is also common for incumbents to honestly believe that the digitization or IT modernization initiatives are insurtech. I have personally been in CXO level meetings where homegrown IT systems being built over decades are perceived as insurtech or digital start-ups! In reality these are simply standard hygiene efforts of maintaining updated IT systems and catering to the need of making business processes available in digital format.

On the other hand, it is also common to see start-ups and MGAs offering pure digital experiences to the customers and promising the lowest costs - which they can because of relatively low overheads of maintaining decaying IT legacy. With small business footprint, it is possible to run the business logic on shared systems provided by the risk underwriter and excel on a laptop. This reality is about cutting costs, working with wafer-thin margins in order to replicate the services that the incumbents offer with a single differentiator - less cost.

Both these approaches are fine and both make money - today; no complaints there! However, whether a simple digitization approach will create enough differentiation to build a sustainable business for the future remains a question mark. In both cases there is a glaring gap: the lack of technology innovation as well as business innovation.

Insurtech situation in the Nordics

Even though pureblood insurtech is not common yet, it is heartening to see the first indicators of the future to come. One such example is Hedvig in Sweden. It has all the elements of a try insurtech: 1. Digital first 2. Leverages technology innovations for core business processes & 3. Business model innovation of using surplus money for social good. Another good example comes from Denmark with Undo, a Tryg company kickstarted as a greenfield start-up initiative. Undo too has the requisites for being a true insurtech. It is 100% digital with user journeys imagined from a mobility perspective by personalising granular insurance for young people.

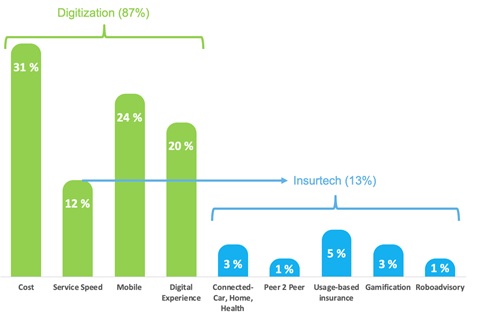

In Figure 2, I have tried to depict the insurance sector investments (perceived as insurtechs) in the Nordic region - Sweden, Finland, Denmark and Finland. The green bars are investment count in hygiene factors rather than real insurtech as I see it. Ideas and hence investment in real insurtech bets are collectively the same number (12-12%) as the smallest investment theme (Service Speed- 12%) on the digitization side. The digitization initiatives are an evolutionary outcome of looking “inside-out”, where the insurance industry is playing catch-up. Digital capability as wrappers on top of existing core functions, investments to support service speed expectations and driving down costs is “business-as-usual”.

However, the “outside-in” convergence (2) is the story that real insurtech initiatives are riding on. IoT, ML, AL etc., are bringing in technology innovation that influence the auto, construction and health sectors among others. These influences create the perfect opportunity for rethinking the concept of risks associated within these industries. Furthermore, societal changes like rise of sharing economy and diluting need of ownership have also shifted risk accountability from individual to distributed and institutionalised. Real insurtechs are leveraging the convergence of technology, societal changes and business innovations to fundamentally rethink the concept of risk and its mitigation and in the process creating solutions that don’t have a precedence. In short, they are not satisfied by the mediocrity of doing things differently. In fact, they are proactively doing different things and changing the playing field.

2: Insurance investment bets by themes in the Nordics

The future?

Like aforesaid, not only are true insurtechs rather rare in the Nordics, there is also the constant challenge of the market dynamics. The latest study (3) published by Oliver Wyman, a global consulting firm, throws in interesting insights on the societal behaviour. The study covered 5000 customers in UK, Spain, France, Germany and Italy. If traditional insurers offered the similar propositions as insurtechs, 61% respondents would prefer to use the traditional insurer. On the banking side, the ratio is higher at 66% preference to use traditional bank instead of neo banks. On an average the trust with traditional insurers and banks is at 60%. Reflecting on the findings of the survey, Fady Khayatt, (Insurance Partner, Oliver Wyman) comments that insurtech offerings are relatively niche. On the other hand, traditional insurers are in much better position to provide new and innovative services to existing as well as new customers. On the banking side Simon Low (Partner and Head of EMEA, Retail & Business Banking) says, “Our survey reveals that traditional banks are well placed to re-capture customers who have switched to neo-provider”.

There is an ever-increasing pile of money on the table for insurtech innovations. Disruptive technology innovations are creating the enablement. New business models are getting invented. Even though the euphoria is tempered down a bit with the market realities, consumer preferences, regulations etc., all the elements to change gears from evolutionary steps to revolutionary jumps are in place. The insurtech revolution is still in infancy but building momentum exponentially.

About the Author: Sameer Datye holds a Ph.D. in Computer Science from University of Jyväskylä, Finland. As part of his job of leading the Digital Insurance & Wealth management initiatives in Tieto, he is deeply passionate about the development in the FinTech, InsurTech and WealthTech areas. The following are his coordinates:

• Tieto’s Digital Insurance & Wealth initiatives

• Sameer Datye on LinkedIn

1 Fintech Global. (2019, August 14). Half of the 1,000 InsurTech deals completed globally since 2014 took place in North America. Retrieved from Fintech Global Website: https://.fintech.global

2 Geum, Y., Moon-Soo, K., & Sungjoo, L. (2016). How industrial convergence happens: A taxonomical approach based on empirical evidences. Technological Forecasting and Social Change(107), 112-120.

3 Oliver Wyman Management Consulting. (2019, August 29). OliverWyman.com. Retrieved from OliverWyman.com: https://www.oliverwyman.com/media-center/2019/aug/survey-reveals-traditional-banks-and-insurers-can-capitalise-on-.html

4 Passler, K. H. (2019, May 20). Digitalization-vs-insurtech. Retrieved from Slide Share: https://www.slideshare.net

5 Passler, K. H. (2019, August 11). Stop Confusing InsurTech with Digitalization. Retrieved from KarlHeinzPassler.com: https://karlheinzpassler.com/