Andelen uføre kvinner er mer enn dobbelt så høy som for menn blant medlemmer i KLPs pensjonsordning, viser tall fra pensjonsleverandøren.

Det er vanlig å se forskjell i uførhet mellom kvinner og menn. Forskjellen ser imidlertid ut til å være større i typiske helse- og omsorgsyrker enn i andre yrker. De senere årene har dessuten uføreandelen blant kvinner økt uten at vi ser samme utvikling for menn i våre data.

Tallene kommer frem i KLPs årlige arbeidslivsrapport, som inkluderer tall, analyse og reportasjer om temaer som yrkesdeltakelse, pensjonering og uførhet blant KLPs medlemmer. KLP er pensjonsselskapet for ansatte i en rekke kommuner og helseforetak i Norge. Rapporten gir innsikt til KLPs eiere, arbeidslivets parter og offentligheten om utfordringer og muligheter i arbeidslivet.

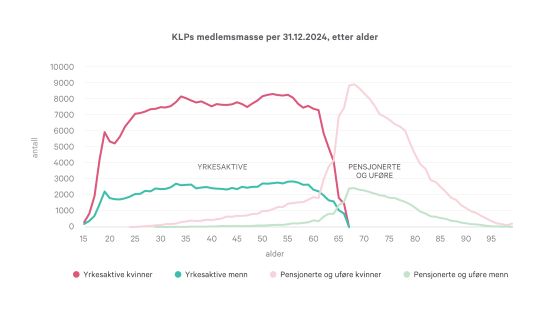

Figur1

Årets rapport tar for seg temaet kvinners arbeidshelse. Det er aktuelt av flere grunner: I en tid der helse- og omsorgssektoren roper etter arbeidskraft, er uførheten blant kvinner vesentlig høyere enn for menn blant KLPs medlemmer, det vil si de med en pensjonsrettighet i KLP. Om det lykkes å redusere uførheten blant kvinner og få flere kvinner til å stå lenger i jobb, vil det hjelpe mye på bemanningskrisen i denne sektoren. Temaet er også aktuelt med bakgrunn i en norsk offentlig utredning i år, og ikke minst det faktum at rundt 3 av 4 av KLPs medlemmer er kvinner.

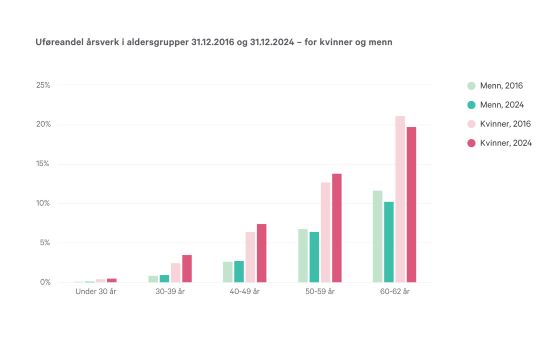

Figur2

Færre yrkesaktive

Til grunn for tallene i arbeidslivsrapporten ligger innsikt om rundt en million med pensjonsrettighet fra KLP. Dersom vi ser på alle som er yrkesaktive eller pensjonert fra aktiv stilling, utgjør yrkesaktive rundt 67 prosent av denne gruppen. Det som gjerne omtales som «forsørgerbyrden» blant KLPs medlemmer, det vil si forholdet mellom antallet personer i jobb og på alderspensjon, var ved utgangen av fjoråret 2,9 yrkesaktive per alderspensjonist.

I arbeidslivsrapporten gjør KLP en ti års fremskrivning av medlemsmassen til 31. desember 2034. Fremskrivningen viser at andelen yrkesaktive reduseres til å bli 61 prosent av medlemsmassen. «Forsørgerbyrden» blant KLPs medlemmer endres til å bli 2,1 yrkesaktive per alderspensjonist. Dette understreker det økte behovet for arbeidskraft, særlig innen helse og omsorg.

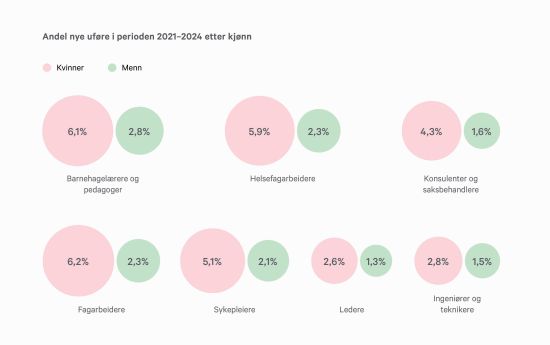

Figur3

1 av 10 er uføre

Blant hovedtallene som kommer frem i årets arbeidslivsrapport, er at uføreandelen blant KLPs medlemmer var på 9,8 prosent.

Det er store forskjeller mellom kjønnene. For kvinner er uføreandelen på 11,4 prosent, mens den for menn er 4,5 prosent. Andelen uføre kvinner er altså langt høyere enn andelen uføre menn, i gjennomsnitt over 2,5 ganger høyere.

Selv når vi korrigerer for deltid og uføregrader, er forskjellen betydelig. Med en slik tilnærming blir uføreandelen 9,5 prosent for kvinner og 4,5 prosent for menn. At forskjellen mellom kvinner og menn er noe lavere når vi ser på årsverkskorrigert uføreandel enn når vi ser på den rene uføreandelen henger sammen med at menn i større grad har høyere uføregrad når de først er uføre.

Uføreandelen er høyere i befolkningen enn i KLPs ordninger. Det er ikke overraskende blant annet fordi folketrygdens tall har med personer som aldri har vært i jobb. Men forskjellen mellom kvinner og menn er betydelig større blant KLPs medlemmer enn i befolkningen. Forholdet mellom uføreandelen for kvinner og menn i KLP er mer enn 2,5, mens forholdet mellom andelen uføretrygdende kvinner og menn i befolkningen er under 1,5.

Fra 2016 til 2024 har uførheten blant kvinner i KLPs medlemsmasse økt betydelig i alle aldersgrupper frem til 60-årene, mens det ikke er samme utvikling blant menn. I den eldste aldersgruppen har uførheten gått noe ned. Nedgang i uføreandel for de eldste er i tråd med hva som rapporteres fra NAV (den norske folketrygden).

Forskjeller i samme yrker

En kunne lett tenke seg at den store forskjellen i uførhet blant kjønnene er at menn og kvinner har ulike yrker. Men også når vi ser på uførhet i spesifikke yrker er det tilsvarende forskjeller.

Størst forskjell mellom kjønnene ser det ut til å være i yrkene der uførheten er høyest. For eksempel blant helsefagarbeidere og fagarbeidere er uførheten mer enn 2,5 ganger høyere for kvinner enn for menn.

Den relative forskjellen avtar noe i yrkene med lavest uførhet. Blant kommunalt ansatte er dette for eksempel stillingskategorier som ledere og ingeniører og teknikere. Likevel er uførheten rundt dobbelt så høy for kvinner enn for menn også i disse gruppene.

Et annet trekk ved uførhet er omfang av gradert uførepensjon. Selv om menn har lavere sannsynlighet for å bli uføre enn kvinner, ser vi at menn oftere er 100 prosent uføre. Av nye mannlige uførepensjonister er i overkant av 50 prosent helt uføre, mens tilsvarende andel for nye kvinnelige uførepensjonister er litt under 45 prosent.

Få kommer tilbake til arbeid

Det gjøres et betydelig arbeid for at personer som er sykmeldte eller uføre skal komme tilbake til arbeid. Her er det viktig å være oppmerksom på at før vi registrerer en uførepensjon i KLP, vil medlemmet ha vært sykmeldt en periode, som regel ett år. KLP har ikke tilgang på informasjon om sykmeldte, og heller ikke de som kommer tilbake i jobb etter å ha vært sykmeldt.

En analyse av KLP-data tilbake til 2009, viser at hvert år blir rundt 3 prosent av uføre medlemmer friske og reaktiveres. Yngre har størst sannsynlighet for å komme tilbake i jobb, og kvinner har svakt høyere reaktiveringssannsynlighet enn menn. Sannsynligheten for reaktivering avtar med alder. Halvparten av de som reaktiveres, gjør det i løpet av det første året, og de fleste kommer tilbake til arbeid mens de fortsatt er sykmeldt, før de går over på uførepensjon. Ikke overraskende er det slik at jo lenger tid som ufør, jo færre er det som kommer tilbake til arbeidslivet.

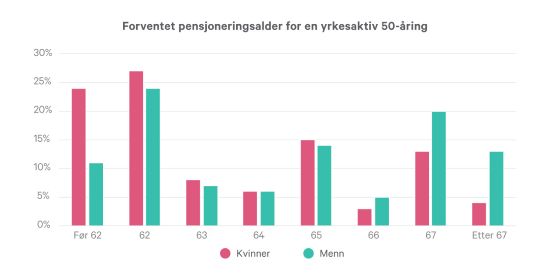

Figur4

Særaldersgrenser og yrker

Ser vi nærmere på KLPs medlemsmasse, er et kjennetegn at mange har særaldersgrense, altså lavere pensjonsalder enn 70 år. Nesten 40 prosent av medlemmene har annen aldersgrense. Av de som har særaldersgrense har de aller fleste (rundt 95 prosent) 65 år som aldersgrense. Dette gjelder blant annet yrkesgrupper som sykepleiere, helsefagarbeidere, fagarbeidere og renholdere. Kvinner er klart overrepresentert i disse yrkene. Flere av disse yrkene har også gjennomgående høyere uførhet enn yrkene med aldersgrense 70 år.

Yrkene med aldersgrense 60 år i KLP er hovedsakelig ambulansearbeidere og brannkonstabler.

Deltidsarbeid og heltidskultur

Deltidsarbeid er utbredt blant KLPs medlemmer, spesielt blant kvinner og i yrker med særaldersgrense. Blant menn med aldergrense 70 år jobber nesten 80 prosent i 100 prosent stilling, mens under halvparten av kvinnene med aldersgrense 65 år har full stilling. Dersom stillingsandelene øker, vil det kunne bidra til å møte fremtidens bemanningsbehov innenfor helse- og omsorgsektoren.

Forventet pensjoneringsalder

KLP gjør også beregninger av forventet pensjoneringsalder for 50-åringer. Metoden er et alternativt mål for gjennomsnittlig tidspunkt for pensjonsuttak og inkluderer både overgang til uføre- og alderspensjon.

Gruppen med høyest forventet pensjoneringsalder er menn med aldersgrense 70 år, mens kvinner med aldersgrense 65 år har lavest forventet pensjoneringsalder. Yrker med stor belastning og høyest andel uføre, som helsefagarbeidere, fagarbeidere og renholdere, er også de som har lavest forventet pensjoneringsalder.

Figur5

Reportasjedel

KLPs arbeidslivsrapport består også av en reportasjedel med bakgrunn i tallene og innsikten fra talldelen. Der kommer det blant annet frem at et arbeidsliv med gode arbeidsmiljøer som legger til rette for ulike livsfaser vil lykkes med å beholde folk lenger i jobb.

Årsakene til forskjellene mellom kvinner og menn er sammensatte, og heller ikke kvinnearbeidshelseutvalget som leverte sin rapport tidligere i år peker på noen entydige sammenhenger, men peker på at det må gjøres mer forskning. Mange av yrkene hvor kvinneandelen og uførheten er høy, har en kombinasjon av fysisk og psykisk belastning. Dette til forskjell fra de typiske mannsdominerte arbeidsplassene i industrien hvor det tradisjonelt har vært mest fysisk belastning.

KLPs arbeidslivsrapport kan leses her