The FME is an independent State Authority which supervises the insurance market, credit market, pension market and securities market. The FME reports to the Minister of Commerce in accordance with the Act on Official Supervision of Financial Operations no. 87/ 1998. The FME was established by a merger of the Bank Inspectorate of the Central Bank of Iceland and the Insurance Supervisory Authority in 1999, when the mentioned Act came into force.

Currently the number of full time employees at the FME is 44 (18 cand. oecon and economists, 12 lawyers, 2 actuaries, 4 computer Scientists, 5 other Specialists, 3 administration staff). Some trainees are also available part-time (such as law students). About 40% of the employees have a higher education from overseas and 26% have work experience from overseas.

1. Legislation and the role of the Financial Supervisory Authority

1.1 Short historical overview

The first Icelandic legislation on insurance activities dates back to 1973 (Act on Insurance Activities no. 26/1973), which contained provisions on the establishment of the Insurance Supervisory Authority. The Authority began its operations on the 1st of January 1974. The mentioned Act was revised in 1978

(with Act no. 50/1978) and then again revised in 1994 (with Act no. 60/1994). During the period 1973 to 1994 there were many restrictions regarding the activities of insurance companies both domestic and foreign, such as prior supervision of policy conditions and premiums. Such prior supervision was abolished with the new legislation in 1994.

There has been a dramatic change in the last 20 years in the structure of thedomestic insurance market in Iceland. Since 1987 the number of insurance companies has decreased from 29 to 12. Many companies operated by special laws (local mutual ship/boat insurance companies and a local compulsory household fire insurance company in Reykjavík) which may have been uncompetitive towards larger insurance companies. In the last 12 years, competition on the market has increased considerably. This situation led to transfers of portfolios and mergers of companies. Fortunately, no insurance companies went bankrupt, but some experienced financial difficulties due to their smallness. Those companies transferred their portfolio and/or merged with other companies as stated before.

The current Act on Insurance Activities no. 60/1994 took into consideration obligations under the EEA Agreement. An Agreement between the government of Iceland, Denmark and the Faroe Islands came into force in 2006, which had also an effect on the legislation. The legislation in force can be found on the FME website (fme.is).

Insurance broking came under official supervision with the mentioned Act on Insurance Activities in 1994. Before that time there were no licensing requirements for brokers. Brokers were only allowed to conduct insurance broking in Iceland on behalf of licensed insurance companies.

Icelandic legislation in the field of insurance and insurance brokerage is coordinated with the EU acquis as provided for by the EEA Agreement. The legislation on insurance activity is in most aspects

congruent with the Third Generation of Insurance Directives as regards insurance companies and legislation of insurance broking is congruent with the Directive on Insurance Mediation 2002/92.

The Act on Insurance Activities no. 60/ 1994 affected the legal position of the parties in question such as the role of the supervisory authority and the role of insurance companies (foreign and domestic) and intermediaries. The legislation increased consumer protection, e.g. by obliging insurers and brokers to provide specific information to the policyholder and the insured on their legal position and rules on the choice of legislation on insurance contracts.

Following is a short overview of some of the changes which the new legislation had regarding the activity and role of the supervisory authority (FME) and/or the supervised parties:

- detailed rules on the establishment of an insurance company,

- detailed rules on possible ancillary activities of an insurance company,

- definition of possible insurance classes and definitions such as qualifying holdings, branch, dominance, partnership etc.,

- detailed rules regarding the supervision of insurance premiums, policy conditions, business conduct, solvency etc.,

- detailed requirements regarding the financial basis and technical provisions of an insurer,

- detailed rules on qualifying holdings (prior notification and requirement of the approval of the FME),

- fit and proper requirements of board members and managers/directors,

- auditing and accounts,

detailed requirement that an insurer seeks the service of an actuary or a specialist with comparable knowledge who can carry out

necessary actuarial calculations and analyses for the company,

- detailed articles on the powers and the role of the supervisory authority,

- detailed articles on the obligation of insurers and brokers to provide information to the policyholder and insured regarding their legal position both when concluding an insurance contract and in the case of a damage/claim,

- detailed articles on the choice of legislation on insurance contracts,

- detailed articles on the possible activity of insurance brokers, which were for the first time put under official supervision,

- detailed articles regarding the activities of foreign insurance companies in Iceland and the possibility for domestic insurance companies to provide services in another Member State of the EEA,

- detailed articles on the transfer of portfolio and mergers and/or dissolution of insurers and withdrawal of licenses.

The FME would like to emphasis the importance of sufficient insurance cover in each given time and the importance of sufficient official supervision both as regards the financial position of the parties in question and their compliance with the legislation in force at each given time. Insurance activity is supervised worldwide, the reason being consumer protection. Insurance activity and ancillary activities shall be carried out in accordance to good business methods in the insurance business and with regard for the interests of the policyholders and the insured. Insurance activity is not purely a commercial business activity but it is a regulated activity. The parties in question have the sole privilege to conduct insurance activity as long as they fulfill the legal requirements of an operating license.

1.2 Main legislation

Iceland, as a member of the EEA, has implemented the relevant EU Directives regarding the Insurance Market, Credit Market and Securities

Market etc. Consequently, the legislation on insurance activity and insurance mediation is in line with the EU Law.

The main legislation regarding the insurance market are the Act on Insurance Activities no. 60/1994 and regulations, Act on Insurance Contracts no. 30/2004, Act on Insurance Mediation no. 32/2005 and regulations, Act on Official Supervision of Financial Operations no. 87/1998 and regulations. Number of other Acts and regulations are mandatory such as third motor liability insurance, household fire insurance, catastrophic insurance, several classes of professional liability insurance etc.

1.3 The role of the FME with emphasis on insurance and insurance mediation

The main responsibility of the FME is the security and stability of the market such as financial requirements and good business practices. The FME shall ensure that the activities of parties subject to supervision are in accordance with laws, regulations, rules or by-laws governing such activities, and that they are in other respects consistent with sound and proper business practices.

The FME believes that it has sufficient powers to be able to conduct its obligations in a sufficient manner. There are 8 employees especially working on insurance supervision with additional support from other employees such as administration, IT-staff and other experts.

Information regarding the financial position/ operations of domestic insurance companies can be found in the FME annual report available on www.fme.is.

Recent changes to the various acts on supervised activities increased the FME ability to decide administrative fines against supervised parties (Act no. 55, 27th March 2007).

1.4 New Act on Insurance Contracts no. 30/2004 (into force in January 2006)

The Act has effect on the legal position of the parties in question such as information requirements of insurance companies (foreign and domestic) and intermediaries. The role model for the new act was the Act on Insurance Contracts in Norway, which dates back to 1989. The act does not handle large risks as defined by the Icelandic legislation whereas large risks do not need the same consumer protection as mass risks.

The Act does increase consumer protection due to provisions such as on the obligation of insurers and brokers to provide information to the policyholder and the insured (consumer) and rules on the choice of legislation on insurance contracts. The Act did legalize the Insurance Complaints Committee which was founded in 1994.

The Act has affected some of the foreign insurers which provide services in Iceland in personal insurance, such as life insurance and sickness and health insurance, because of mandatory provisions regarding information requirements. Due to that some of the insurers have been evaluating whether they should keep on providing services in Iceland. These insurers believe that the legislation may be too burdensome, but time will tell what their position will be.

1.5 New Act on Insurance Mediation no. 32/2005

The new Act on Insurance Mediation came into effect in 2005. The legislation is in conformity with the Insurance Intermediaries Directive no. 2002/92. The legislation has requirements regarding fit and proper insurance brokers and agents and their employees, registration, licensing and detailed requirements regarding the obligation of the broker and/or agents to provide the consumer with sufficient information in connection with an insurance contract such as the reason why

the consumer (policyholder) should conclude a specific insurance contract. The FME has reason to believe that brokers and agents need to put more emphasis on the fulfillment of the information requirements. They must each time give the policyholder a written statement clarifying the reasons for the specific insurance cover.

The FME participates internationally in a working group on behalf of CEIOPS (Committee of European Insurance and Occupational Pension Supervisors) which is among other things examining the issue when an insurance broker or agent should be considered providing services in another member state. At the moment this seems to be unclear in relation with the mentioned Directive.

Should it be the intention of the broker/ agent or the location of the risk or the residence of the policyholder? The FME believes that the focus should be on the intention of the intermediary (broker/agent) when concluding whether he is considered providing services in another Member State. Another possible solution would be to look at the residence of the policyholder and/or the location of the risk, but time will tell what the final solution will be. If the intermediary has the intention to provide services abroad he would clearly fall under the so-called notification procedure and then be required to notify his intentions to his home country supervisory authority which would then notify his intentions to the host country supervisory authority.

2. Supervised parties and recent developments in the market

In this section the FME focus solely on the parties under supervision by the FME. In section IV the FME discusses the activity of foreign insurance companies.

2.1 Intermediaries (brokers and/or agents):

The domestic insurance brokers are 6 (direct

supervision by the FME):

Árni Reynisson ehf.

Fjárfestingarmiðlun Íslands ehf.

Nýja vátryggingaþjónustan ehf.

Olaf Forberg

Tryggingamiðlun Íslands ehf.

Tryggingar og ráðgjöf ehf.

The FME has registered about 3 600 foreign insurance brokers and/or agents which are authorized to conduct insurance mediation in Iceland. They have gone through a specific notification procedure and come under the so-called home country control system in accordance with the EEA Agreement.

2.2 Insurance companies:

In total there are twelve companies under supervision. There are:

- four life insurance companies,

- four general non-life insurance companies

- two companies (Íslensk endurtrygging hf. and Trygging hf.) are running off their reinsurance portfolio,

- European Risk Insurance Company hf. (ERIC), which writes liability insurance only in the UK,

- The State Natural Catastrophe Fund. The four life insurance companies and the four general non-life companies are all parts of consolidations which are in one way or another connected to each of the three largest banks in Iceland, Kaupthing hf. (Kaupthing),Glitnir hf. (Glitnir) and Landsbanki Íslands hf. (Landsbanki). The increased consolidation and foreign activity calls for increased group supervision by the FME. The FME will within few days publish for consultation draft rules on the definition and capital adequacy of financial conglomerates. The FME does ex

pect that the rules will come into force later this year.

Following are information on those eight insurance companies, their relation to each other and their links to the abovementioned

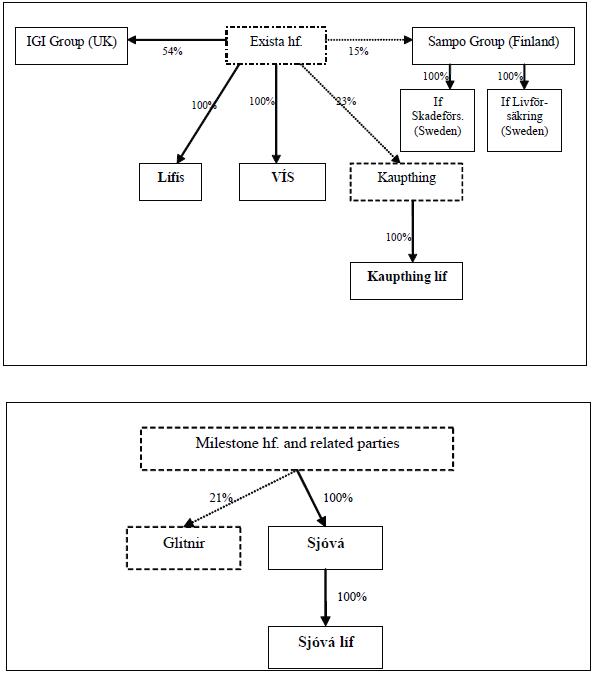

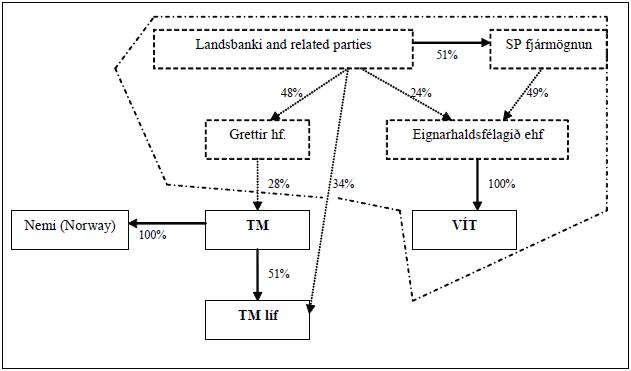

banks. In the graphs insurance companies are shown in solid boxes and other companies in dashed boxes. Majority ownerships are illustrated with solid arrows, while other qualifying holdings are illustrated with dotted arrows.

Vátryggingafélag Íslands hf. (VÍS) is a nonlife company and is responsible of the daily operations of the life insurance companyLíftryggingafélag Íslands hf. (Lífís). Both companies are owned by Exista hf., which is a mixed insurance holding company. In addition Exista has a majority holding in the UK insurer IGI Group. Recently Exista hf. acquired a 15.48% holding in the Finnish insurer Sampo Abp. Sampo has (through holding companies which for simplicity are not shown in the graph) a 100% share in the Swedish companies If Skadeförsäkring AB and If Livförsäkring AB. It also owns companies in the Baltic states.

VÍS and Lífís are linked to Kaupthing by Exista’s 23% share in the bank. Additionally Kaupthing owns it’s own life insurance company, Kaupthing líftryggingar hf. (Kaupthing líf).

Sjóvá-Almennar tryggingar hf. (Sjóvá) is a non-life insurance company and owns the life insurance company Sjóvá-Almennar líftryggingar hf. (Sjóvá líf). Sjóvá is fully owned by the mixed insurance holding company Milestone hf. and it’s related parties. Milestone hf. owns a 21% share in Glitnir, but due to recent news in the media the FME does expect changes regarding the holdings of Glitnir.

Tryggingamiðstöðin hf. (TM) is a non-life insurance company and owns the majority in the life insurance company Líftryggingamiðstöðin hf. (TM líf). TM has a 100% share in the Norwegian insurance company Nemi Forsikring ASA.

The second largest shareholder in TM is Grettir hf., an investment company. Landsbanki and related parties have a 48% share in Grettir and 34% share in TM líf.

Vörður Íslandstrygging hf. (VÍT), the smallest of the general non-life insurance companies is fully owned by the holding company Eignarhaldsfélagið ehf. Landsbanki has interests in VÍT through its share in the

holding company and their majority in the leasing company SP fjármögnun.

The FME is currently processing an application from new parties to acquire the holding of Grettir hf. in TM1. The potential change is shown with dotted lines in the graph below. Landsbanki’s holding in TM líf is not subject to change at this moment.

2.3 Recent developments

Non-life insurance

The non-life operations have not been profitable in recent years but due to high profits from investment activities the total profit in this sector has never been higher than it was in the year 2005.

The total premiums of non-life insurers in 2005 were 23.9 billion ISK (273 million Euro). Thereof were 50.1% from motor insurance. As motor insurance is the most important sector in non-life insurance the financial outcome of the companies depends on its developments. In the next section the FME will discuss recent premium changes in motor insurance.

Life insurance

The size and the income of life insurance companies have been steadily growing in recent years. The companies have different profiles. Sjóvá líf writes more unit linked business than the other companies, hence the low claims ratio. TM líf was founded in 2002 and is much smaller than the other companies.

The total amount of premiums in life insurance in 2005 was 2.5 billion ISK (28 million Euro) or 9.7% of the premiums in non-life insurance.

3. The FME and the insurance market - some current projects

3.1 Risk management and stress test

In January 2006, the FME issued Guidance no. 1/2006 on stress test and companies’ disclosure of their risk management. With the guidance the FME took a significant step towards a risk based supervision approach. The purpose of the guidance is also to make the companies better prepared for the Solvency

II implementation in 2010.

The guidance is divided into three parts:

a) Standardized stress test

The financial situation of all companies is tested for a 35% fall in equities, 7% fall in bonds and 20% fall in reinsurers’ share in technical provisions. Additionally, the effects of scenarios related to underwriting risk are tested for different kinds of companies. For life insurers, a 25% increase in compensation is tested. For general non-life insurers the effect of probable maximum loss in property or marine insurance and 150% claims ratio in the most significant line of business is tested. Finally, for non-life insurers which are classified as either monoline or specialized, a 200% claims ratio is tested.

The results of the stress tests are used by the FME to classify the companies into risk classes. The classification is used as a factor to decide the level of supervision.

b) Companies’ own stress test

If companies have certain risks that are not captured adequately by the standardized stress test they should be prepared to make their own stress tests. The companies have until the end of 2007 to submit their procedures or workbooks to the FME.

c) Supervision of risk management

Finally, the guidance describes the different risks insurance companies have to manage, and how the companies must submit such information to the FME. In October 2006, the companies submitted to the FME for the first time information on how they measure and manage different types of risks.

3.2 Data processing and early warning system

In 2007, the FME implemented a new internet-based system for exchanging information with parties under supervision. The aim of this is to reduce the use of paper and use more secure communication channels than e-mails. The FME still has to process the data manually and transfer it to relevant databases. A significant amount of time is used to find and ask companies to correct errors. The next step will therefore be that data will be transmitted automatically to the databases after it has been cheeked for errors. The companies will not be able to send reports with errors.

Another step in the improvement of data processing will be a new early warning (traffic light) system, which the FME is currently working on. The system will make use of data in supervision more efficient than today.

3.3 Premium levels

The FME has the role to secure the fairness of the policyholders’ premiums. The premiums must be in accordance with the real risk and related costs. Supervisory authorities in the EEA generally do not have that role. The Insurance Directives do not allow authorities to accept premiums beforehand but the FME has the powers to prohibit changes in premiums retroactively.

Recently the insurance companies have been criticized in the media for increases in premiums in motor insurance at the same time as the companies report record profits. As seen in previous chapter, the profits have mostly been generated by financial operations. According to the companies, the year 2006 was a very bad year for motor insurance with claims on the increase.

In January, the FME by a request from the Minister of Commerce, answered questions from a member of the Parliament. The member asked about the companies’ profits in recent years, the developments of claims provisions and companies’ allocation of the profit from financial operations to the insurance business.

In its answer, the FME made reference to prior studies of premiums in motor insurance in 1999 and 2004 where it was found that claims provisions were overestimated. The FME could however not relate the level of premiums directly to the overestimation. Today, the FME has reason to believe that there is less if any overestimation. Additionally, the FME has not had reason to question the allocation of profit from financial operations.

The FME has published the results of a study on the premiums in life insurance. The study did not lead to remarks on the level of premiums but the FME will impose a higher demand on information from the companies’ actuaries on premium decision procedures.

3.4 Fit and proper testing of Managing Directors, Board Members and Insurance Brokers

The FME has administered a special fit and proper test for Managing Directors and Members of the Board of insurance companies and insurance brokers and other supervised entities such as banks and pension funds and securities firms.

The parties in question must fulfill specific fit and proper requirements in accordance with the Icelandic legislation. When nominated, the party in question must be notified to the FME. They are then required to answer a questionnaire which they must send to the FME. The Managing Directors and Brokers are also required to take an oral test at the FME (which takes about 3 hours each time). The FME evaluates whether the party fulfills the legal requirements and is considered fit and proper. The FME has successfully had this procedure for many years.

4. International activity, domestic and foreign insurers

Since 1994, when Iceland became part of the EEA, a large number of foreign insurance companies have notified their intention to either provide services in Iceland without an establishment or to open a branch. The first domestic insurance company notified the FME of its intention to provide services without an establishment in the EEA in 1997. Its intention was to insure Icelandic companies’ interests in the EEA.

4.1 Activities of foreign insurance companies and insurance intermediaries.

Insurance companies

Today, there are 267 foreign insurance companies registered and 2 of them have opened a branch, Allianz Lebensversicherung AG and Allianz Versicherungs AG. Only a small part of these foreign insurance companies are actually active in Iceland. The foreign insurance companies have mainly been involved in life insurance and in nonlife insurance in aviation, marine and cargo insurance. The foreign life insurance companies have around 1/3 of the life insurance market, but the ratio seems to be decreasing. One reason for this change could be the decrease in the number of licensed insurance brokers firms from 10 in the year 2004 to currently 6.

Insurance intermediaries

Since the new Law on Insurance Mediation no. 32/2005 came into effect in June 2005, about 3 600 foreign insurance intermediaries have notified their intention to provide services in Iceland. None of them has opened a branch. This high number of foreign insurance intermediaries does not mean increased activities of foreign insurance intermediaries in Iceland compared to before the new law came into force. This increase in cross border notification from intermediaries is not unique in Iceland but is similar in other EEA countries and has surprised members of the EEA. CEIOPS established an expert group on intermediaries

which prepared a Protocol which CEIOPS has published. The Protocol provides a framework for the cooperation of competent authorities with regard to the implementation of the Insurance Mediation Directive. The expert group is currently, as mentioned before in this Article, reviewing the Protocol regarding the notification procedure.

4.2 Cross border activities of domestic insurance companies and domestic insurance intermediaries

Insurance companies

As mentioned earlier, Icelandic insurance companies have been providing cross border

services in the EEA since 1997. None of them has opened a branch. ERIC has opened a representative office in the UK. The company received its license in 2003 and operates only in general liability insurance and only in the UK. Other insurance companies, providingservices in the EEA are, VÍS, Sjóvá, TM, TMlíf, Kaupthing líf and VÍT. Even though some insurance companies have had license to do cross border business since 1997 their involvement in the European market has been very limited. It was not until 2005 that the companies began to increase their activities with focus on the Nordic countries and the UK.

In 2006, TM bought a Norwegian insurance company, Nemi Forsikring ASA. The companies recently started writing contracts in cooperation. The FME is the lead supervisor of the TM consolidation. The role of a lead supervisor is, in accordance to a protocol between supervisory authorities of the EEA Member States (so-called Helsinki Protocol), to coordinate supervision and have an overview of the consolidation. TM is also a party in co-insurance with a Swedish insurance company.

Sjóvá and the British insurance company, Royal & Sun Alliance, collaborate in providing Icelandic international companies collective insurance for their interests abroad.

Foreign activities of an insurer calls for caution because of different rules regarding the selection of insurance contract law and rules of specific compulsory insurance and general good provisions. The preparation of the insurer must be well thought through.

Insurance intermediaries

The Icelandic insurance intermediaries have not yet followed their European counterparts and notified of their intention to provide services on the EEA following the adoption of the Insurance Mediation Directive. Perhaps the reason for it is that insurance brokerage is a relatively new trade in Iceland and the Icelandic insurance intermediaries are still establishing themselves in Iceland.

The Icelandic insurance intermediaries have predominantly been in business with European insurance companies and concentrated mostly on personal insurance.

5. Final words

For the last 20 years there have been dramatic changes in the insurance market in Iceland. The number of domestic insurance companies has decreased. Competition has increased. There have been many changes in the legislation which has increased consumer protection. Insurance mediation has established itself.

The Icelandic insurance companies have been increasing their activities abroad as other Icelandic financial companies have done in recent years. The main reasons are to insure Icelandic interests abroad, limitations of expansion in Iceland and to diversify the risk.

Applications for qualifying holdings in Icelandic insurance companies have increased the last few years. One of the characteristics is the fact that there are relatively few owners of large qualifying holdings.

The Icelandic insurance market is secure and financially sound and the FME believes it has sufficient powers to conduct its obligation in a sufficient manner.

Notes

1 An investment company, FL Group has 45% share in a holding company (Kjarrhólmi ehf.) which is applying for acqcusition of in total 33% share in TM, previously owned by Grettir hf. and Landsbanki. FL Group has a qualifying holding in Glitnir.